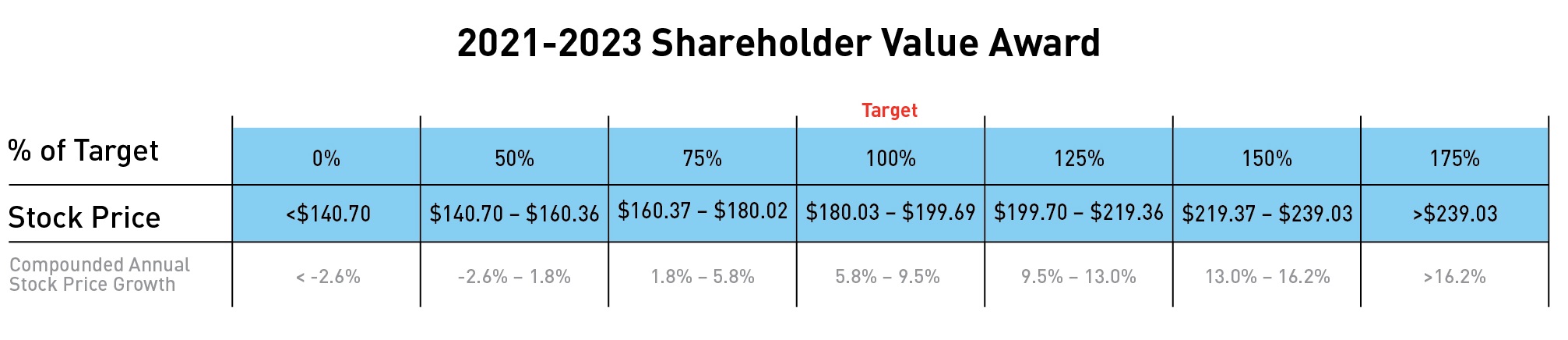

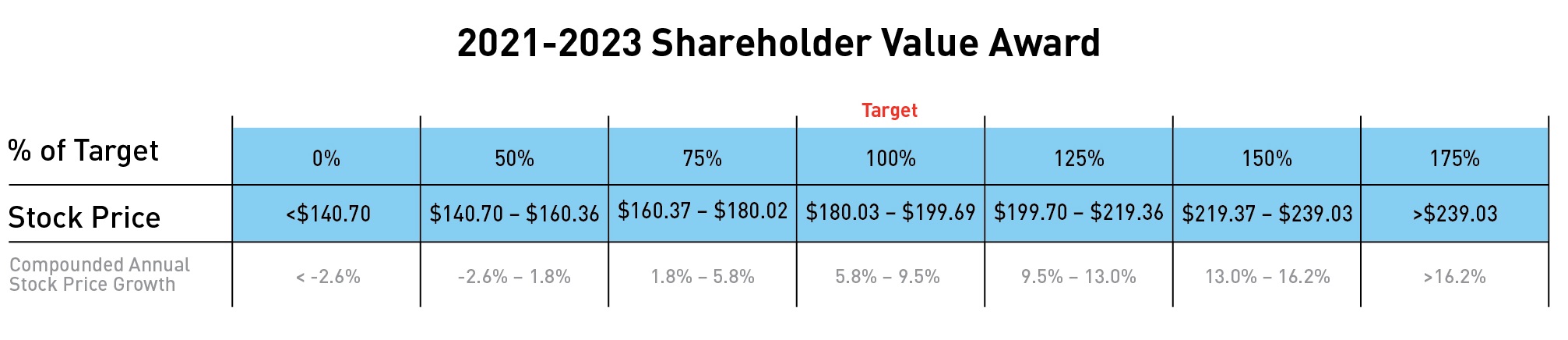

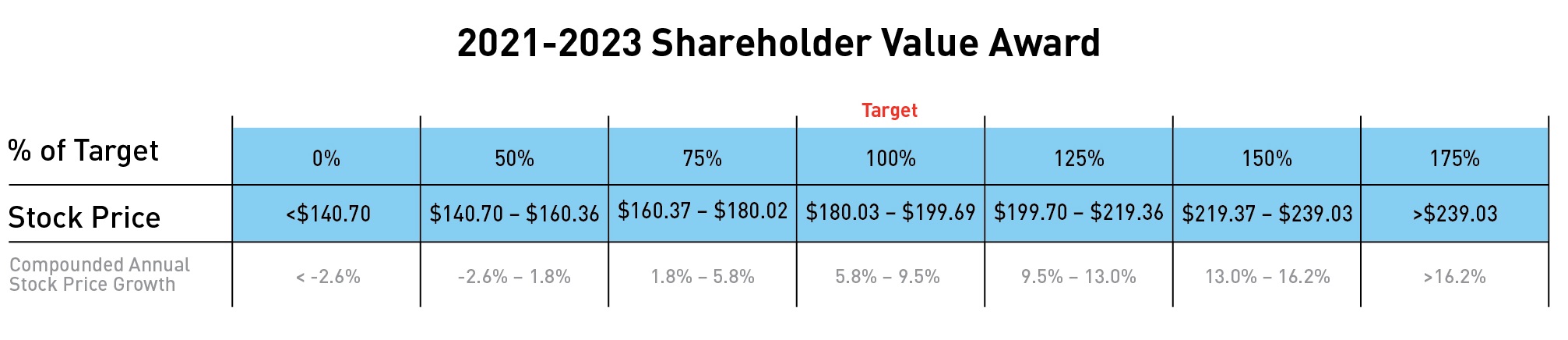

For purposes of establishing the stock price target for the shareholder value awards, the starting price was $72.15$152.16 per share, the average closing stock price for all trading days in November and December 2016.2020. The target share price was established using the expected annual rate of return for large-cap companies (8 percent), less an assumed Lilly dividend yield of 2.88 percent.(2.23 percent). To determine payout, the ending price will be the average of the closing pricesprice of company stock for all trading days in November and December 2019.2023. The award is designed to deliver no payout to executive officers if the shareholder return (including projected dividends) is zero or negative. Possible payouts based on share price ranges are illustrated in the grid below.

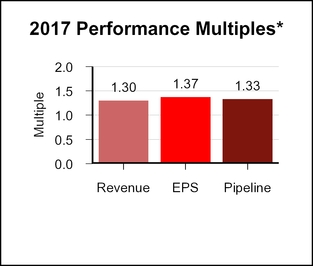

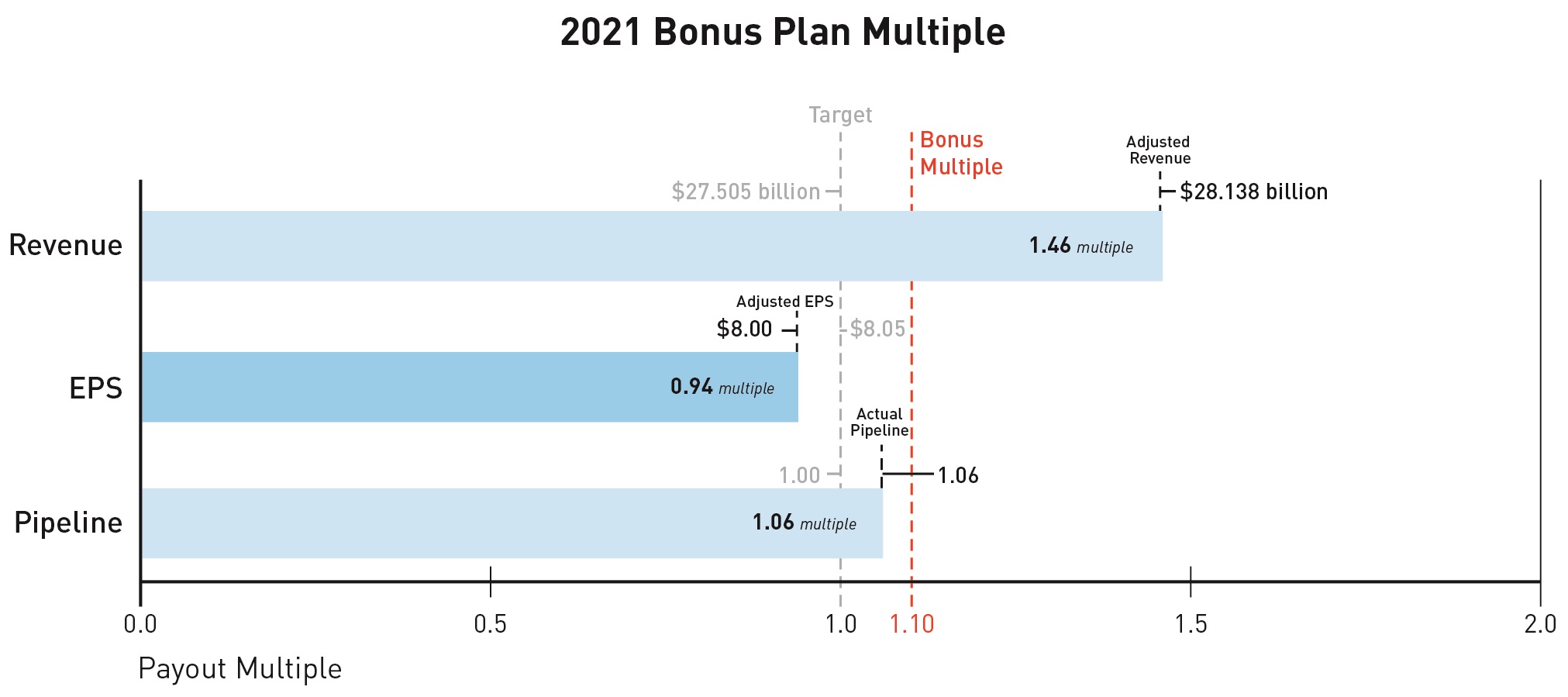

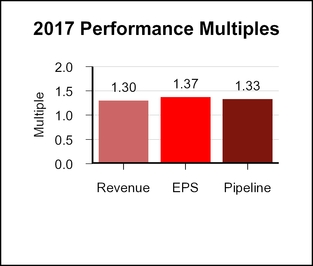

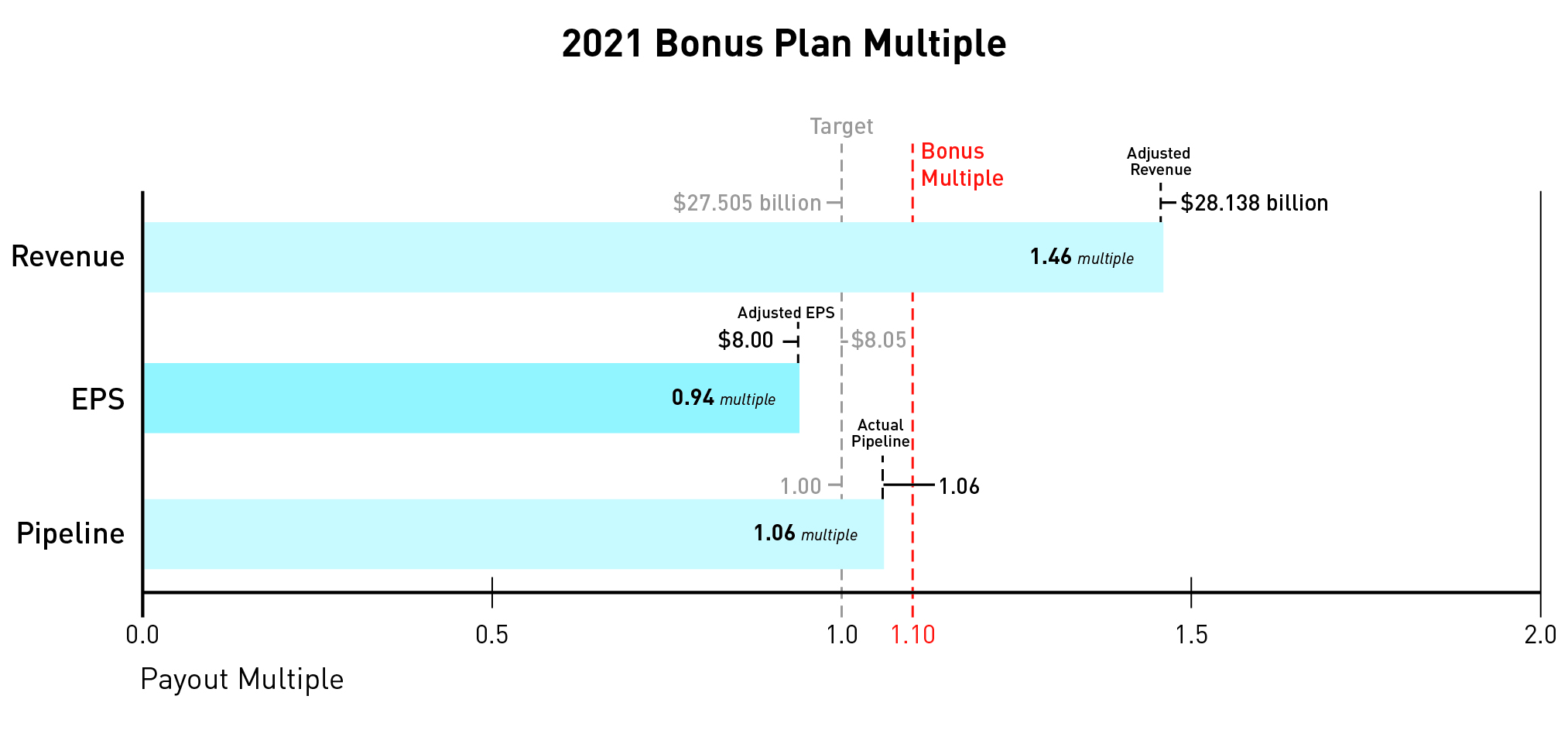

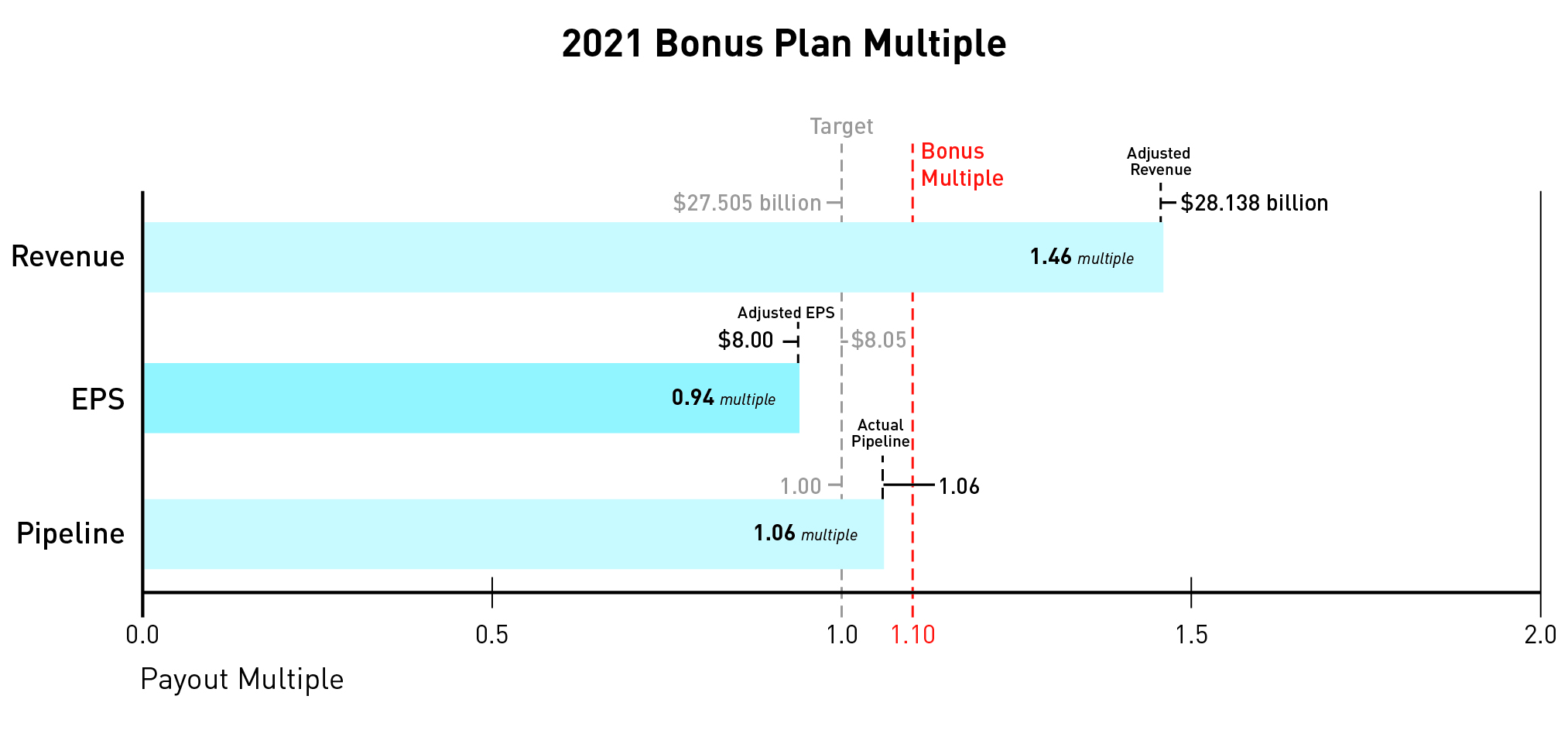

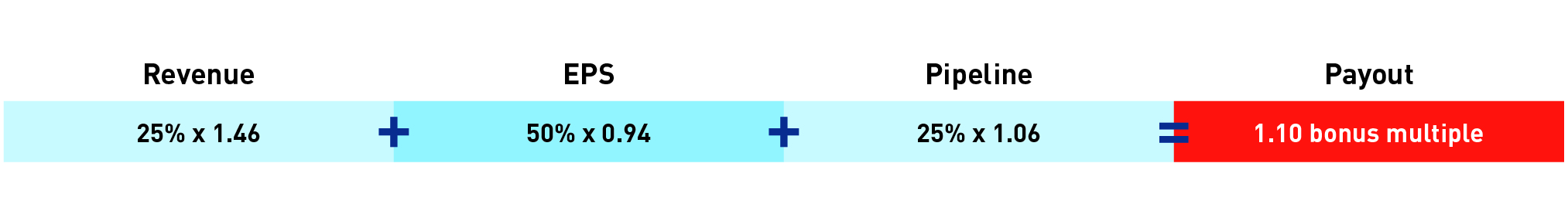

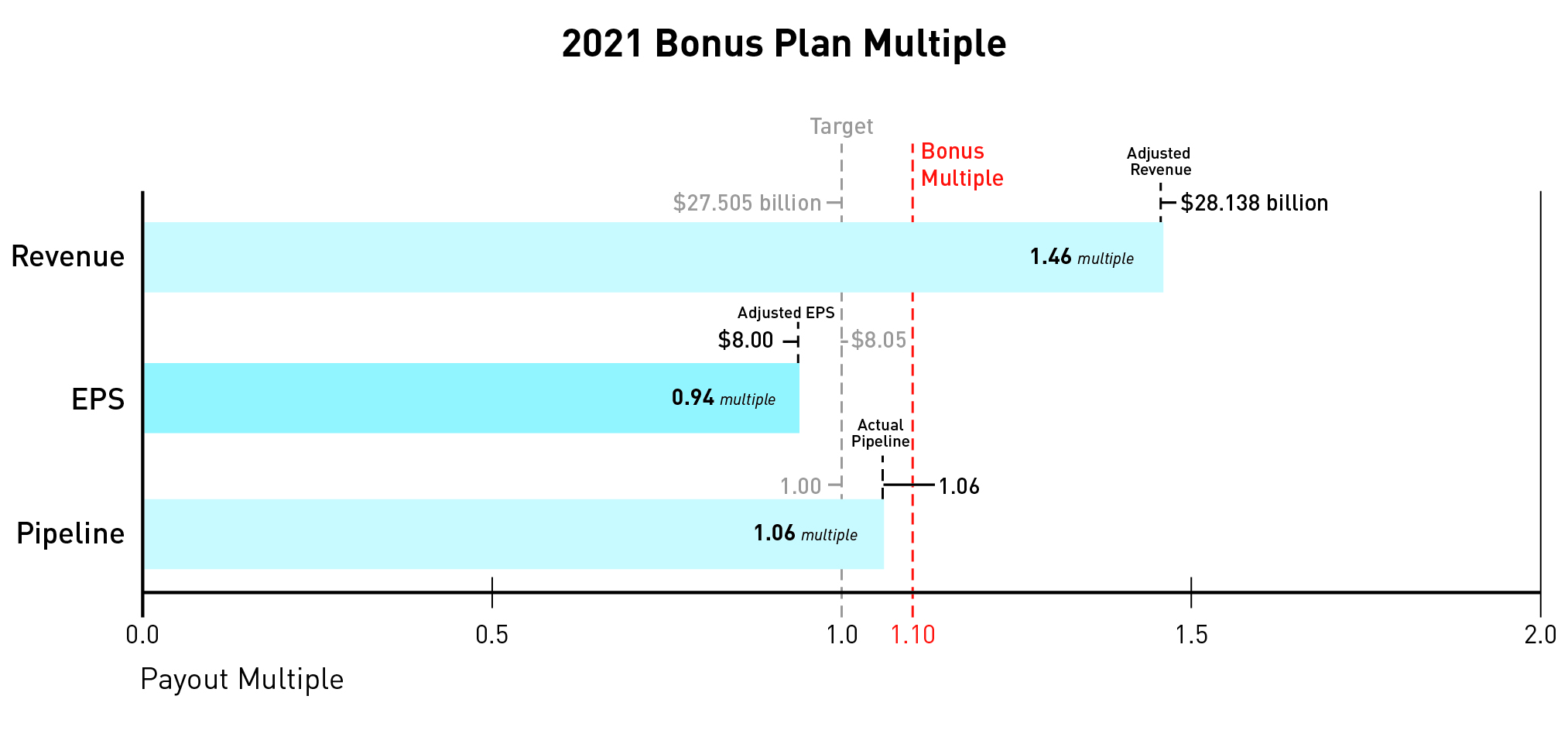

Based on the recommendation of the Science and Technology Committee, the Compensation Committee certified a pipeline score of 3.65, resulting inapproved a pipeline multiple of 1.33.1.06.

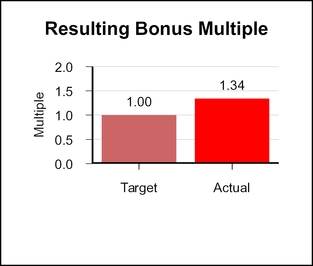

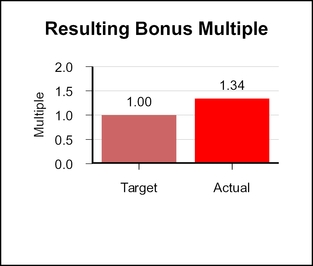

When combined, the revenue, EPS, and pipeline multiples yielded a bonus multiple of 1.34.1.10.

Members of senior management may defer receipt of part or all of their cash compensation under The Lilly Deferred Compensation Plan (Deferred Compensation Plan), which allows executives to save for retirement in a tax-effective way at minimal cost to the company. Under this unfunded plan, amounts deferred by the executive are credited at an interest rate of 120 percent of the applicable federal long-term rate, as described in more detail following the “Nonqualified"Nonqualified Deferred Compensation in 2017”2021" table.

The company has adopted change-in-control severance pay plans for nearly all employees, including the executive officers. The plans are intended to preserve employee morale and productivity and encourage retention in the face of the disruptive impact of an actual or rumored change in control. In addition, the plans are intended to align executive and shareholder interests by enabling executives to evaluate corporate transactions that may be in the best interests of the shareholders and other constituents of the company without undue concern over whether the transactions may jeopardize the executives’ own employment.

Although benefit levels may differ depending on the employee’s job level and seniority, the basic elements of the plans are comparable for all eligible employees:

•Excise taxtax:. In some circumstances, the payments or other benefits received by the employee in connection with a change in control could exceed limits established under Section 280G of the Internal Revenue Code. The employee would then be subject to an excise tax on top of normal federal income tax. The company does not reimburse employees for these taxes. However, the amount of change in control-related benefitsany change-in-control-related benefit will be reduced to the 280G limit if the effect would be to deliver a greater after-tax benefit than the employee would receive with an unreduced benefit.

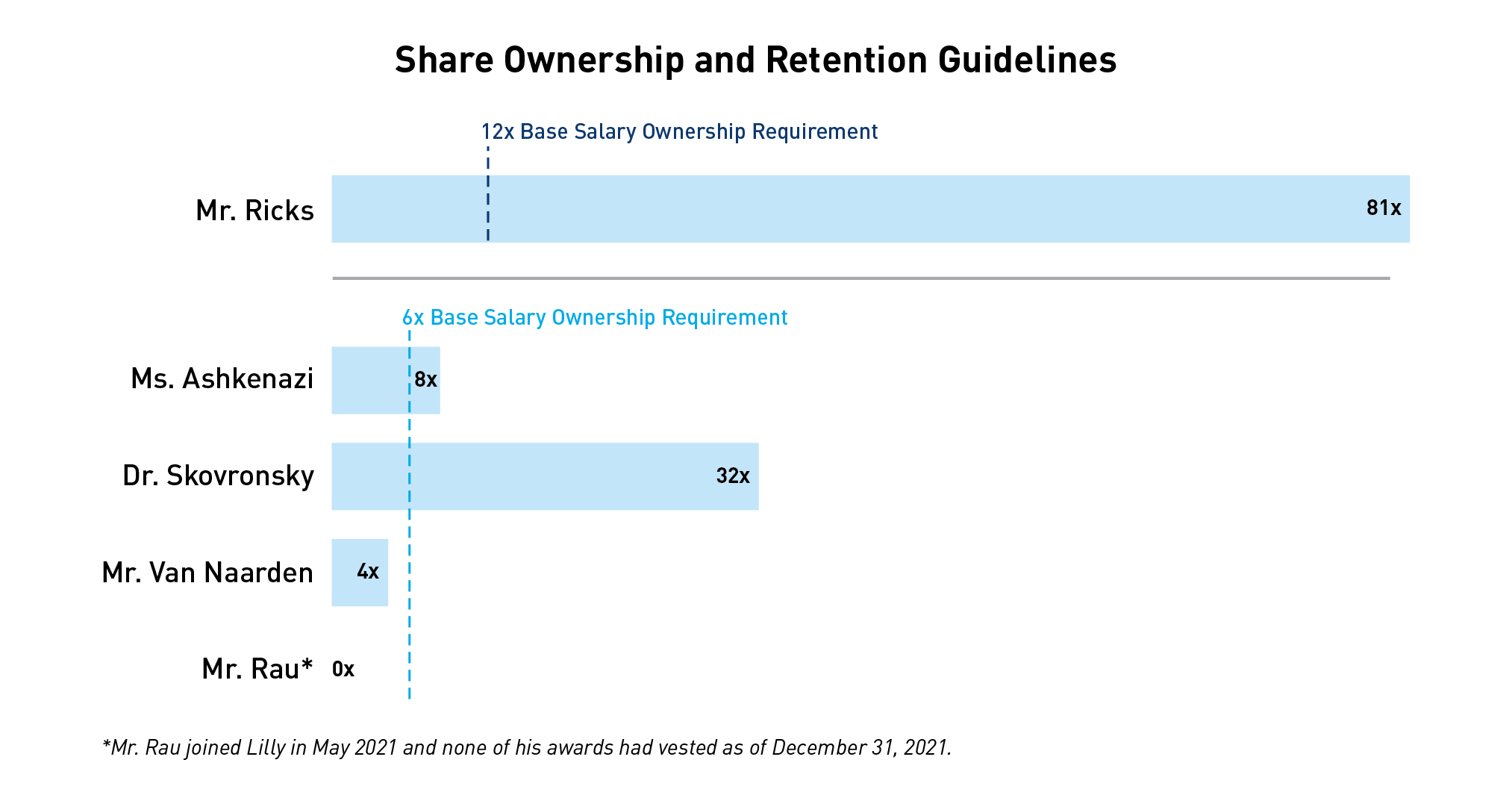

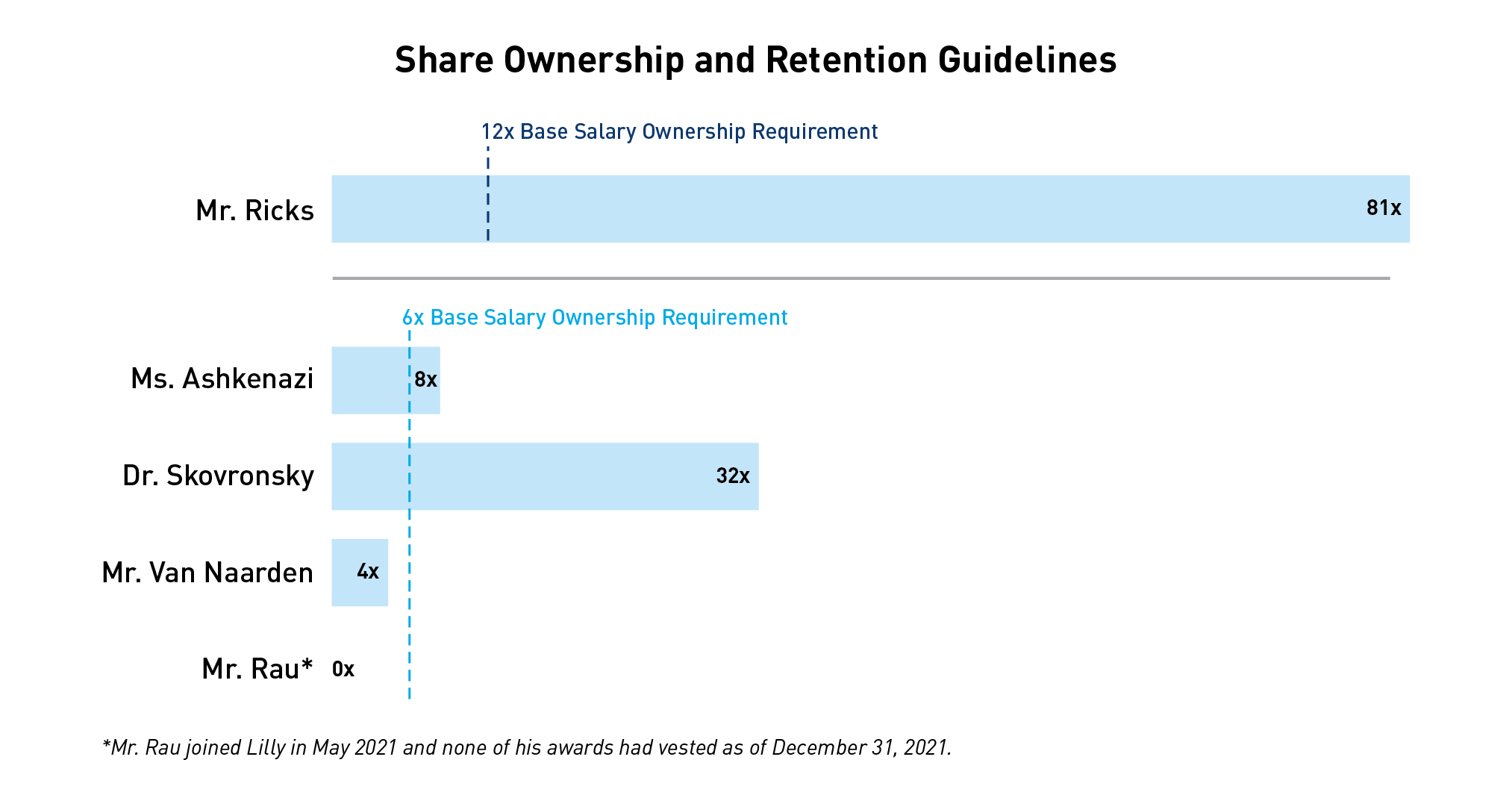

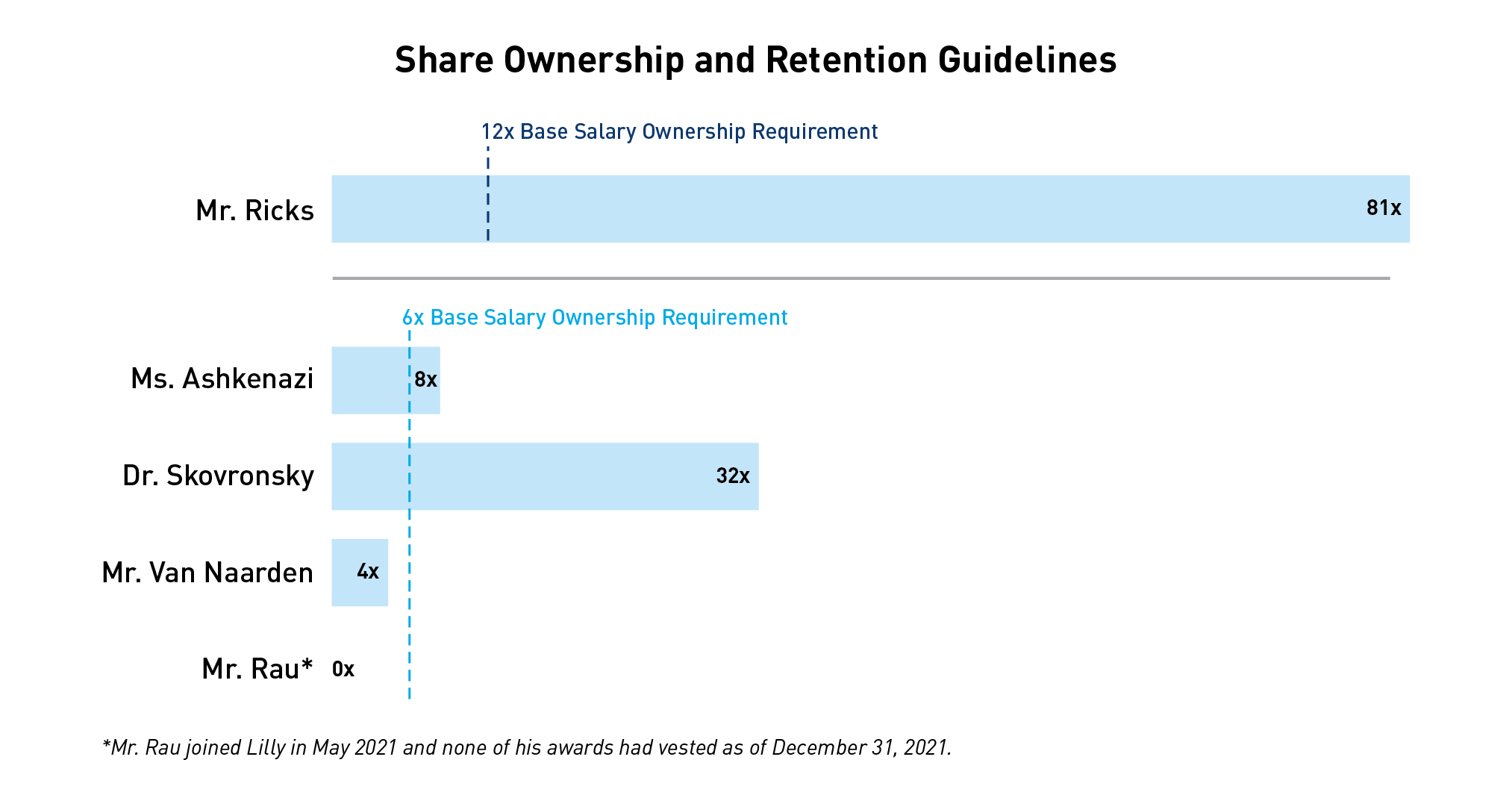

Share Ownership and Retention Guidelines; Prohibition on Hedging and Pledging Shares

GuidelinesShare ownership and retention guidelines help to fostercreate direct alignment of interests between senior management and shareholders over the longer term. Lilly has established a focus on long-term growth. Theformal share ownership policy under which the CEO isand other senior executives are required to own company stock valued at least six times annualacquire and hold Lilly shares in an amount representing a multiple of base salary. During 2017,2021, the holding requirementCompensation Committee approved an increase to share ownership requirements for the CEO and the other named executive officers ranged from two to three times annual base salary depending on the position. Beginning in 2018, the holding requirement for other executive officers will range from two to four times annual base salary depending on the position. as follows:

| | | | | | | | |

| Previous Share Ownership Requirement | Current Share Ownership Requirement |

| CEO | 6X Base Salary | 12X Base Salary |

| Other NEOs | 4X Base Salary | 6X Base Salary |

Until ownership of the required number of shares is reached, thean executive officer must retainhold 50 percent of all shares, net of taxes receivedtax, from newall equity payouts. Our executives have a long history of maintaining significant levels of company stock. As of December 31, 2017, Mr. Ricks held shares valued at approximately 8 times his annual salary. The following table shows the share requirements for the named executive officers:

|

| | | |

Name | Share Requirement

2017 2018

| Owns Required 2018 Shares |

Mr. Ricks | six times base salary | six times base salary | Yes |

Mr. Conterno | three times base salary | four times base salary | Yes |

Mr. Rice (retired) | three times base salary

| four times base salary | Yes |

Dr. Lundberg | three times base salary

| four times base salary | Yes |

Mr. Harrington | three times base salary

| four times base salary | Yes

|

Executive officers are also required to hold all shares received from equity program payouts, net of acquisition costs and taxes, for at least one year, even once share ownership requirements have been met. For performance awards granted to executive officers, this holding requirement is met by the 13-month service-vesting period that applies after the end of the performance period.

All of the named executive officers are compliant with the share ownership guidelines. The following graphic shows each respective named executive officer's guideline and each named executive officer's holdings as of December 31, 2021, other than Mr. Smiley, who resigned effective as of February 9, 2021.

Prohibition on Hedging and Pledging Shares

Non-employee directors and employees, including executive officers, are not permitted to hedge their economic exposures to company stock through short sales or derivative transactions. Non-employee directors and all members of senior managementemployees, including executive officers, are prohibited from pledging any company stock (i.e., using company stock as collateral for a loan or trading shares on margin).

Executive Compensation Recovery Policy

AllPursuant to our executive compensation recovery policy (the Executive Compensation Recovery Policy), all incentive awards are subject to forfeiture upon termination of employment prior to the end of the performance or vesting period or for disciplinary reasons. In addition, the Compensation Committee has adopted an executive compensation recovery policy that givesupdates to the Executive Compensation Recovery Policy to be effective January 1, 2022 (the Executive Compensation Recovery Policy, as updated and effective January 1, 2022, the Updated Executive Compensation Recovery Policy) which provides the Compensation Committee broad discretion

to claw back incentive payoutsnon-qualified retirement benefits accrued beginning January 1, 2022 from any member of senior management (approximately 150 employees) whose misconduct results in a material violation of law or company policy that causes significant harm to the company or who fails in his or her supervisory responsibility to prevent such misconduct by others.

Additionally,Pursuant to the Executive Compensation Recovery Policy, the company cancould recover all or a portion of any incentive compensation and, effective as of January 1, 2022 pursuant to the Updated Executive Compensation Recovery Policy, the company could also recover non-qualified retirement benefits accrued beginning January 1, 2022 from an executive officer incentive compensation in the case of materially inaccurate financial statements or material errors in the performance calculation, whether such inaccuracies or not theyerrors result in a restatement and whether or not the executive officer has engaged in wrongful conduct.

The recovery policyExecutive Compensation Recovery Policy covers any incentive compensation awarded or paid to an employee at a time when he or she is a member of senior management.management during the last three years and, effective as of January 1, 2022 pursuant to the Updated Executive Compensation Recovery Policy, covers non-qualified retirement benefits accrued beginning January 1, 2022. Subsequent changes in status, including retirement or termination of employment, do not affect the company’s rights to recover compensation under the policy. Recoveries under

The company will disclose decisions to take action pursuant to the plan can extend back as far as three years.

Looking AheadUpdated Executive Compensation Recovery Policy in its proxy materials when required by, and in compliance with, SEC rules and regulations and other applicable laws. In addition, when legally permissible to 2018 Compensation

Lilly’s Board of Directors unanimously elected Joshua L. Smiley to assume the role of Senior Vice President and Chief Financial Officer effective January 1, 2018, succeeding Mr. Rice, who retired fromdo so, the company atwill disclose a decision to take action under this policy when the end of 2017. In connection with his appointment, Mr. Smiley will receive a base salary of $875,000facts and will be eligible for an annual cash bonus with a target of 95 percent of base salary. Mr. Smiley received an equity award in February 2018 as partcircumstances of the company’s annual equity incentive program with a grant valuematter that triggered application of $2.3 million. One hundred percent of this grant value was deliveredthe policy have been publicly disclosed in the form of performance-based equity: 60 percent in shareholder value awardscompany’s filings with the SEC and 40 percent in performance awards.

where disclosure can be made without prejudicing the company and its shareholders.

The principles of our robust Updated Executive Compensation Recovery Policy are also incorporated into the terms of our incentive plans and award agreements, which, in the event of misconduct meeting the standards described above, allow the Compensation Committee approved new share ownership guidelines for named executive officers other thanto reduce or cancel awards or payouts that would otherwise have been earned based on company performance. Action by the CEO. WhileCompensation Committee to reduce or cancel awards or payouts can occur during or following the CEO’s requirement remains six times his annual base salary, the named executive officers' requirement increased from three times to four times annual base salary.relevant performance period.

Compensation Committee Matters

Background

Role of the Independent Consultant in Assessing Executive Compensation

SummaryThe Compensation Table

|

| | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | Year | Salary

($) | Bonus

($) | Stock Awards

($) 1 | | Option Awards

($) | Non-Equity Incentive Plan Compensation

($) 2 | Change in

Pension Value

($) 3 |

| All Other Compensation

($) 4 | Total Compensation

($) |

| David A. Ricks | 2017 |

| $1,400,000 |

| $0 | $10,200,000 | | $0 |

| $2,814,000 |

| $1,347,991 |

|

| $84,000 |

|

| $15,845,991 |

|

Chairman, President, and

Chief Executive Officer | 2016 | N/A | N/A | N/A | | N/A | N/A | N/A |

| N/A | N/A |

| 2015 | N/A | N/A | N/A | | N/A | N/A | N/A |

| N/A | N/A |

| Enrique A. Conterno | 2017 |

| $762,002 |

| $0 | $6,000,000 |

| $0 |

| $816,866 |

| $999,426 |

|

| $45,720 |

|

| $8,624,014 |

|

Senior Vice President and

President, Lilly Diabetes and President, Lilly USA | 2016 |

| $727,960 |

| $0 | $2,200,000 | | $0 |

| $681,371 |

| $935,408 |

|

| $43,678 |

|

| $4,588,417 |

|

| 2015 |

| $705,653 |

| $0 | $2,270,000 | | $0 |

| $852,075 |

| $0 | 5 |

| $42,339 |

|

| $3,870,067 |

|

| Derica W. Rice (retired) | 2017 |

| $1,089,134 |

| $0 | $4,560,000 | | $0 |

| $1,459,440 |

| $1,719,690 |

|

| $65,348 |

|

| $8,893,612 |

|

Executive Vice President,

Global Services and

Chief Financial Officer | 2016 |

| $1,067,805 |

| $0 | $3,800,000 | | $0 |

| $1,249,332 |

| $1,739,429 |

|

| $64,068 |

|

| $7,920,634 |

|

| 2015 |

| $1,045,200 |

| $0 | $4,313,000 | | $0 |

| $1,514,495 |

| $0 | 5 |

| $62,712 |

|

| $6,935,407 |

|

| Jan M. Lundberg, Ph.D. | 2017 |

| $1,024,643 |

| $0 | $4,320,000 | | $0 |

| $1,373,021 |

| $618,333 |

|

| $61,479 |

|

| $7,397,476 |

|

Executive Vice President, Science

and Technology and President,

Lilly Research Laboratories | 2016 |

| $1,007,855 |

| $0 | $3,600,000 | | $0 |

| $1,179,190 |

| $627,381 |

|

| $60,471 |

|

| $6,474,897 |

|

| 2015 |

| $1,007,855 |

| $0 | $3,859,000 | | $0 |

| $1,460,382 |

| $390,645 |

|

| $60,471 |

|

| $6,778,353 |

|

| Michael J. Harrington | 2017 |

| $856,130 |

| $0 | $2,760,000 | | $0 |

| $917,771 |

| $1,657,718 |

|

| $51,368 |

|

| $6,242,987 |

|

Senior Vice President and

General Counsel | 2016 |

| $827,400 |

| $0 | $2,300,000 | | $0 |

| $774,446 |

| $1,441,954 |

|

| $49,644 |

|

| $5,393,444 |

|

| 2015 |

| $784,167 |

| $0 | $2,610,500 | | $0 |

| $946,881 |

| $391,899 |

|

| $47,050 |

|

| $4,780,497 |

|

Committee has retained Frederic W. Cook & Co., Inc. (FW Cook) as its independent compensation consultant. FW Cook reports directly to the Compensation Committee, and it is not permitted to have any business or personal relationship with management or members of the Compensation Committee. FW Cook’s responsibilities are to:

1 •This column showsreview the grant date fair valuecompany’s total compensation philosophy, peer group, and target competitive positioning for reasonableness and appropriateness;

•review the company’s executive compensation program and advise the Compensation Committee of evolving best practices;

•provide independent analyses and recommendations to the Compensation Committee on the CEO’s pay;

•review the draft CD&A and related tables for the proxy statement;

•proactively advise the Compensation Committee on best practices for board governance of executive compensation; and

•undertake special projects at the request of the Compensation Committee chair.

FW Cook interacts directly with members of company management only on matters under the Compensation Committee’s oversight and with the knowledge and permission of the Compensation Committee chair.

Role of Executive Officers and Management in Assessing Executive Compensation

With the oversight of the CEO and the senior vice president of human resources and diversity, the company’s global compensation group formulates recommendations on compensation philosophy, plan design, and compensation for executive officers (other than the CEO, as noted below). The CEO provides the Compensation Committee with a performance assessment and compensation recommendation for each of the other executive officers. The Compensation Committee considers those recommendations with the assistance of its compensation consultant. The CEO and the senior vice president of human resources and diversity attend Compensation Committee meetings; however, they are not present for executive sessions or any discussion of their own compensation. Only non-employee directors and the Compensation Committee’s consultant attend executive sessions.

The CEO does not participate in the formulation or discussion of his pay recommendations. He has no prior knowledge of the recommendations that FW Cook makes to the Compensation Committee.

Risk Assessment Process

As part of the company's overall enterprise risk management program, in 2021 (consistent with prior years), the Compensation Committee reviewed the company’s compensation policies and practices and concluded that the programs and practices are not reasonably likely to have a material adverse effect on the company. The Compensation Committee noted numerous policy and design features of the company’s compensation programs and governance structure that reduce the likelihood of inappropriate risk-taking, including, but not limited to:

•Only independent directors serve on the Compensation Committee

•The Compensation Committee engages its own independent compensation consultant

•The Compensation Committee has downward discretion to lower compensation plan payouts

•The Compensation Committee approves all adjustments to financial results that affect compensation calculations

•Different measures and metrics are used across multiple incentive plans that appropriately balance cash/stock, fixed/variable pay, and short-term/long-term incentives

•Incentive plans have predetermined maximum payouts

•Performance objectives are challenging but achievable

•Programs with operational metrics have a continuum of payout multiples based upon achievement of performance awardsmilestones, rather than "cliffs" that might encourage suboptimal or improper behavior

•A compensation recovery policy is in place for all members of senior management; negative compensation consequences can result in cases involving serious compliance violations

•Meaningful share ownership and shareholder value awards computedretention requirements are in accordance with FASB ASC Topic 718. See Note 11place for all members of senior management and the consolidatedboard.

Compensation Committee Report

The Compensation Committee evaluates and establishes compensation for executive officers and oversees the deferred compensation plan, management stock plans, and other management incentive and benefit programs. Management has the primary responsibility for the company’s financial statements and reporting process, including the disclosure of executive compensation in the company’sCD&A. With this in mind, the Compensation Committee has reviewed and discussed the CD&A with management. Based on this discussion, the Compensation Committee recommended to the board that the CD&A be included in this proxy statement and the company's Annual Report on Form 10-K for the fiscal year ended December 31, 20172021, for additional detail regarding assumptions underlyingfiling with the valuationSEC.

Compensation Committee

Ralph Alvarez, Chair

J. Erik Fyrwald

Kimberly H. Johnson

Juan R. Luciano

Karen Walker

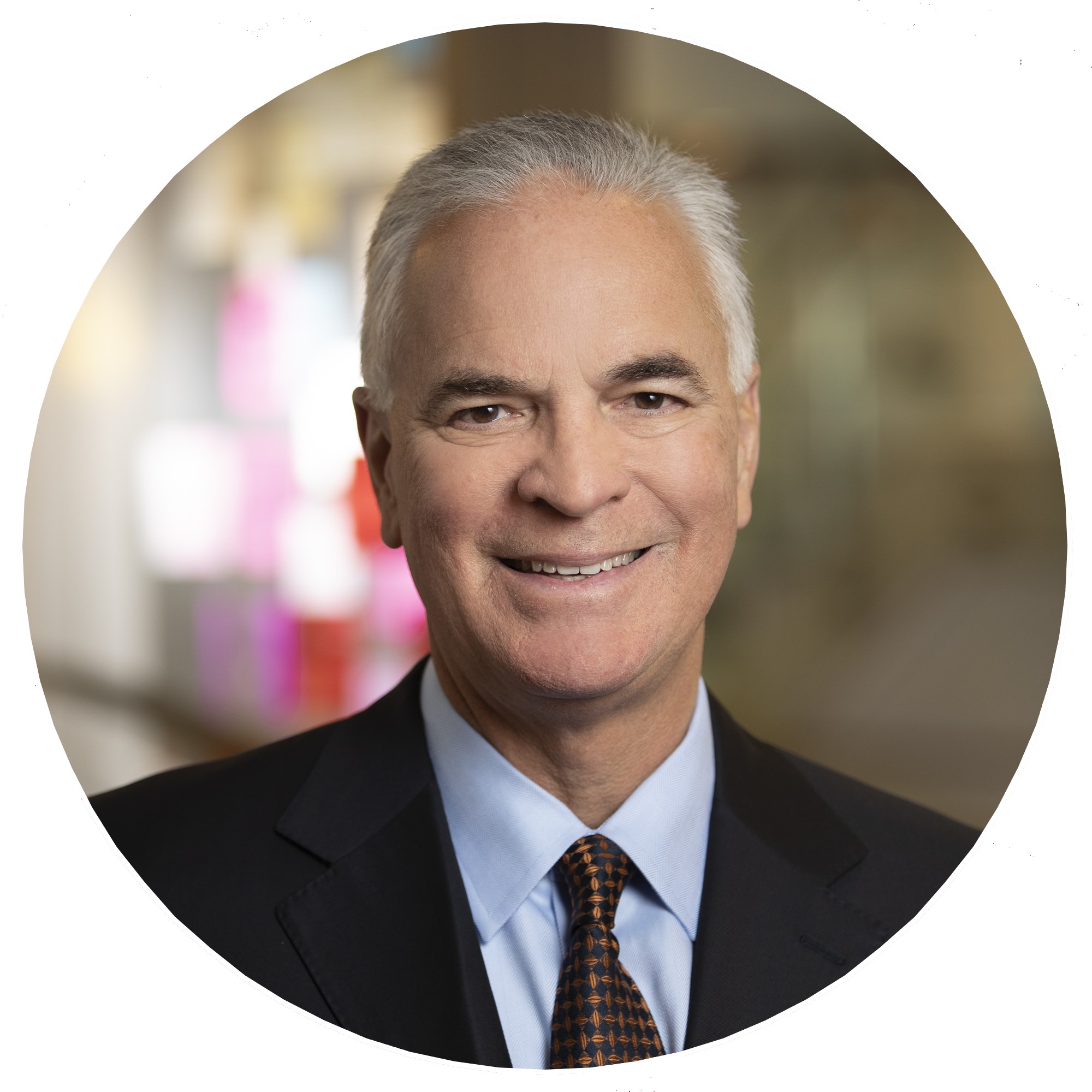

Compensation Discussion and Analysis

This CD&A describes our executive compensation philosophy, the Compensation Committee’s process for setting executive compensation, the elements of equity awards. Allour compensation program, the factors the Compensation Committee considered when setting executive compensation for 2021, and how the company’s results affected incentive payouts. This CD&A provides compensation information for our chief executive officer, David Ricks, our chief financial officer, Anat Ashkenazi, and our next three most highly compensated executive officers who were serving as executive officers on December 31, 2021, Daniel Skovronsky, Jacob Van Naarden and Diogo Rau. The CD&A also includes our former chief financial officer, Joshua Smiley, who resigned from his officer position on February 9, 2021.

| | | | | |

| Name and principal occupation |

| David A. Ricks Chair, President and CEO |

| Anat Ashkenazi Senior Vice President and Chief Financial Officer |

| Daniel Skovronsky, M.D., Ph.D. Senior Vice President, Chief Scientific and Medical Officer and President, Lilly Research Laboratories |

| Jacob Van Naarden Senior Vice President, CEO Loxo Oncology at Lilly and President, Lilly Oncology |

| Diogo Rau Senior Vice President and Chief Information and Digital Officer |

Four of our named executive officers, Ms. Ashkenazi, Mr. Van Naarden, Mr. Rau and Mr. Smiley, served in their respective roles for a portion of 2021. Ms. Ashkenazi succeeded Mr. Smiley as senior vice president and CFO on February 9, 2021. Prior to becoming CFO, Ms. Ashkenazi served as senior vice president, controller and chief financial officer, Lilly Research Laboratories.

Mr. Van Naarden became senior vice president, CEO of Loxo Oncology at Lilly and President of Lilly Oncology on September 5, 2021. He previously served as CEO of Loxo Oncology at Lilly. Mr. Rau joined Lilly as senior vice president and chief

information and digital officer on May 17, 2021. Prior to joining Lilly, Mr. Rau served as senior director, information systems and technology for retail and online stores at Apple, Inc.

Our Philosophy on Compensation

At Lilly, our purpose is to unite caring with discovery to create medicines that make life better for people around the world. To do this, we must attract, engage, and retain highly talented individuals from a variety of backgrounds and motivate them to create long-term shareholder value by achieving top-tier corporate performance while embracing the company's core values of integrity, excellence, and respect for people. Our compensation programs are designed to help us achieve these goals while balancing the long-term interests of our shareholders and customers.

Objectives

Our compensation and benefits programs are based on the following objectives:

•Reflect individual and company performance: We reinforce a high-performance culture by linking pay with individual and company performance. As employees assume greater responsibilities, the proportion of total compensation based on absolute company performance, relative company performance and shareholder returns increases. We perform annual reviews to ensure our programs provide an incentive to deliver long-term, sustainable business results while discouraging excessive risk-taking or other adverse behaviors.

•Attract and retain talented employees: Compensation opportunity is market competitive and reflects the level of job impact and responsibilities. Retention of talent is an important factor in the “Stock Awards” column were based upondesign of our compensation and benefit programs.

•Implement broad-based programs: While the probable outcomeamount of performance conditions ascompensation paid to employees varies, the overall structure of our compensation and benefit programs is broadly similar across the organization to encourage and reward all employees who contribute to our success.

•Consider shareholder input: Management and the Compensation Committee consider the results of our annual say-on-pay vote and other sources of shareholder feedback when designing executive compensation and benefit programs.

Say-on-Pay Results

At our 2021 annual meeting of shareholders, greater than 95 percent of the grant date, which varyshares cast voted in favor of the company's say-on-pay proposal on executive compensation. Management and the Compensation Committee view this vote as supportive of the company's overall approach toward executive compensation.

Compensation Committee's Processes and Analyses

Setting Compensation

The Compensation Committee considers individual performance assessments, compensation recommendations from the CEO (with respect to each of the other executive officers), company performance, peer group data, input from its compensation consultant, and its own judgment when determining compensation for the company's executive officers.

•Individual performance: Generally, the independent directors, under the direction of the lead independent director, meet with the CEO at the beginning of each year to year. For 2017,establish the probable outcomeCEO's performance objectives. At the end of the year, the independent directors meet to assess the CEO's achievement of those objectives along with other factors, including contribution to the company’s performance, awardsdiversity, ethics, and integrity. This evaluation is used in setting the CEO's compensation opportunity for the next year.

The Compensation Committee receives individual performance assessments and target compensation recommendations from the CEO for each of the remaining executive officers. Each executive officer’s performance assessment is based on the achievement of objectives established at the start of the year, as well as other factors, including contribution to the company's performance, diversity, ethics, and integrity. The Compensation Committee considers these inputs, its knowledge of and interactions with each executive officer, and its judgment to develop a final individual performance assessment. For new executive officers, target compensation is set by the Compensation Committee at the time of grant was at maximum. Aspromotion or offer.

•Company performance: Lilly performance is considered in multiple ways:

•Overall prior year performance is a result,factor in setting target compensation for the values incoming year.

•At the "Stock Awards" columnbeginning of each calendar year, annual performance goals are above target. For Mr. Conterno, this column shows both the grant date fair value of performance awardsestablished and shareholder value awards, as well as a special retention grant of $3 million he received in recognition of his leadership in delivering the company's strategy and providing continuity in a time of significant transition at the company; this special retention grant will vest on December 11, 2021, and it will be forfeited if Mr. Conterno resigns or retires from the company prior to that date.

For purposes of comparison, the supplemental table below shows the total target grant values approved by the committee:compensation committee. Performance against these annual goals is used to determine the short-term cash incentive payout.

•Prior to the annual equity grant, multi-year performance goals are established and approved by the compensation committee. Performance against these multi-year objectives is used to determine the long-term incentive equity payout.

|

| | | |

| Name | 2015 Total Equity | 2016 Total Equity | 2017 Total Equity |

| Mr. Ricks | N/A | N/A | $8,500,000 |

| Mr. Conterno | $2,000,000 | $2,200,000 | $2,500,000 |

| Mr. Rice (retired) | $3,800,000 | $3,800,000 | $3,800,000 |

| Dr. Lundberg | $3,400,000 | $3,600,000 | $3,600,000 |

| Mr. Harrington | $2,300,000 | $2,300,000 | $2,300,000 |

•Input from independent compensation consultant:The Compensation Committee considers the advice of its independent compensation consultant, FW Cook, when setting executive officer compensation.

Competitive Pay Assessment

Lilly’s peer group is composed of companies that directly compete with Lilly, use a similar business model, and employ people with the unique skills required to operate an established biopharmaceutical company. The Compensation Committee selects a peer group whose median market cap and revenue are broadly like Lilly's. The Compensation Committee reviews the peer group at least every three years. The Compensation Committee established the following peer group in May 2018 for purposes of assessing competitive pay:

| | | | | | | | | | | | | | | | | | | | |

| AbbVie | | Bristol-Myers Squibb | | Merck | | Sanofi |

| Allergan* | | Celgene* | | Novartis | | Shire* |

| Amgen | | Gilead | | Novo Nordisk | | Takeda |

| AstraZeneca | | GlaxoSmithKline | | Pfizer | | |

| Biogen | | Johnson & Johnson | | Roche | | |

| *Market data unavailable for assessing competitive 2021 pay due to business mergers. |

At the time of the review in May 2018, all peer companies were no greater than two times our revenue or market cap except Johnson & Johnson, Novartis, Pfizer, and Roche. The Compensation Committee included these four companies despite their size because they compete directly with Lilly, have similar business models, and seek to hire from the same pool of management and scientific talent.

When determining pay levels for target compensation, the Compensation Committee considers an analysis of market competitive pay for each executive officer position (except CEO), along with internal factors such as the performance and experience of each executive officer. The independent compensation consultant for the Compensation Committee provides a similar analysis when recommending pay levels for the CEO. The CEO analysis includes a comparison of our CEO actual total direct compensation in the prior year to company performance on an absolute and relative basis. The analysis also includes a comparison of current target total direct compensation for our CEO to the most recently available data on CEO target total direct compensation for our peer group with an emphasis on peers that are headquartered in the U.S. On average, the named executive officers' target total direct compensation for 2021 was comparable to the median of the peer group.

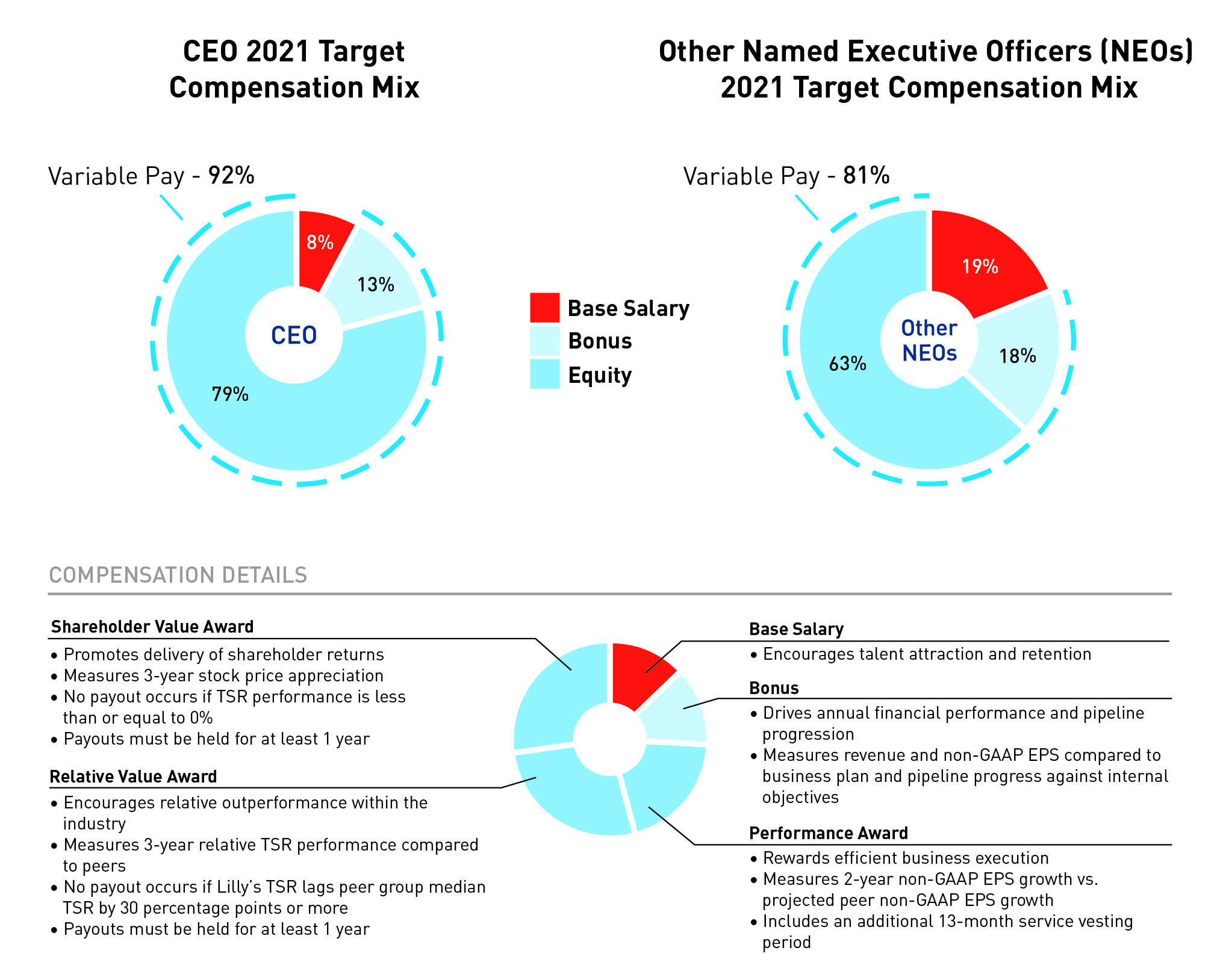

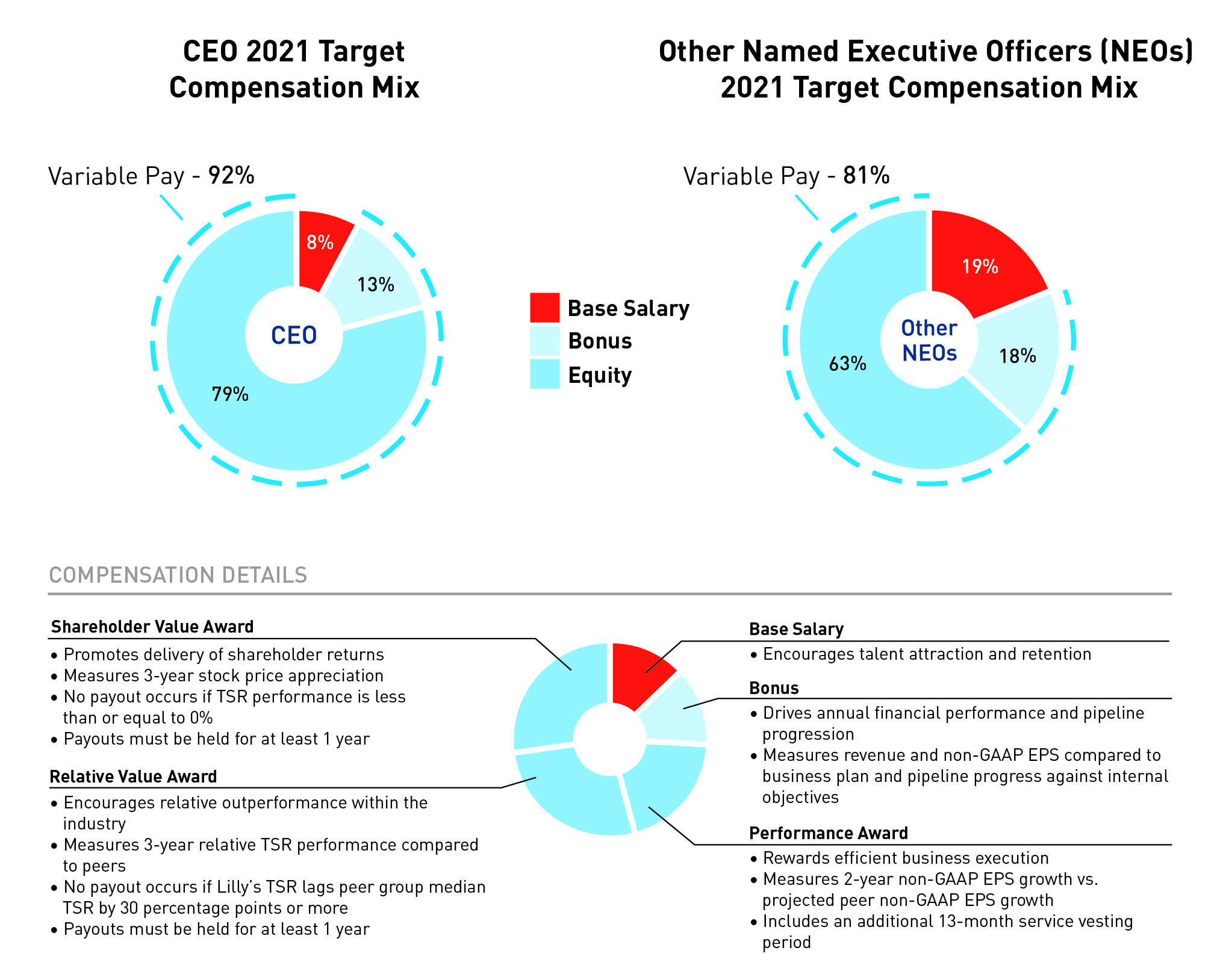

Components of Our Compensation

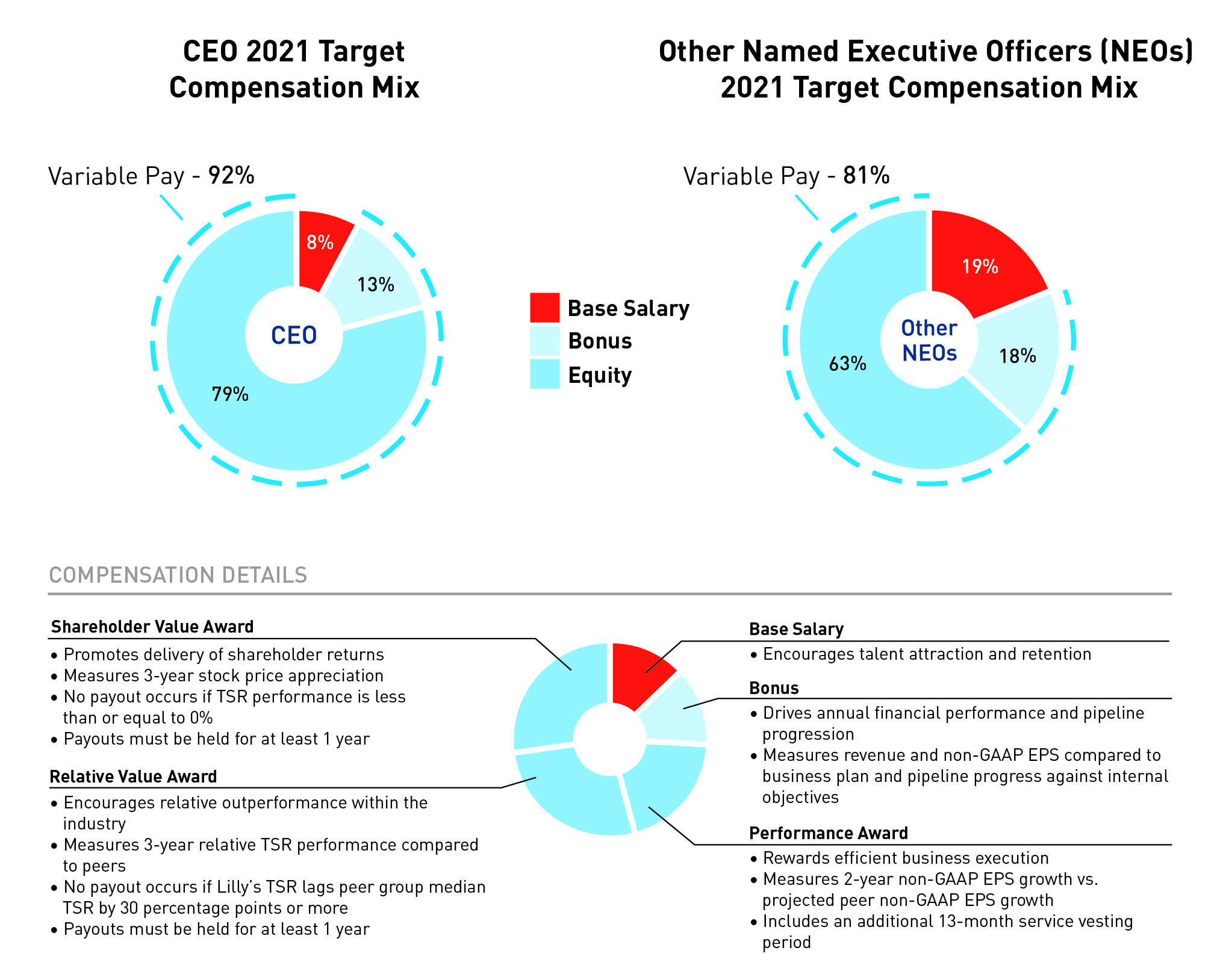

Our 2021 executive compensation was primarily composed of three components:

•base salary

•annual cash bonus, which is generally based on company performance relative to internal targets for revenue, EPS, and the progress of our pipeline

•three different forms of equity incentives:

◦performance award, which is a performance-based equity award that vests over three years. Payout is based on the company's two-year growth in EPS relative to the median external analyst anticipated peer group EPS growth. The earned shares are then subject to a 13-month service-vesting period

◦shareholder value award, which is a performance-based equity award that pays out based on absolute company stock price growth measured over a three-year period, followed by a one-year holding period

◦relative value award, which is a performance-based equity award that pays out based on company TSR results relative to peers measured over a three-year period, followed by a one-year holding period.

Executives also receive a company benefits package, described below under "Other Compensation Practices and Information—Employee Benefits."

Adjustments to Reported Financial Results

The tableCompensation Committee has authority to adjust the company's reported revenue and EPS upon which incentive compensation payouts are determined to eliminate the distorting effect of unusual income or expense items. The adjustments are intended to:

•align award payments with the underlying performance of the core business

•avoid volatile, artificial inflation or deflation of awards due to unusual items in any year in the performance period

•eliminate certain counterproductive short-term incentives—for example, incentives to refrain from acquiring new technologies, to defer disposing of underutilized assets, or to defer settling legacy legal proceedings to protect current bonus payments

•facilitate comparisons with peer companies.

The Compensation Committee considers the adjustments approved by the Audit Committee for reporting non-GAAP EPS and other adjustments, based on guidelines approved by the Compensation Committee prior to the performance period. The Compensation Committee reviews and approves adjustments on a quarterly basis and may adjust payouts for items, including but not limited to, the impact of significant acquisitions or divestitures, the impact of share repurchases that differ significantly from business plan, and large swings in foreign exchange rates. Further details on the adjustments for 2021 and the rationale for making these adjustments are set forth in Appendix A, "Summary of Adjustments Related to the Annual Cash Bonus and Performance Award." For ease of reference, throughout the CD&A and the other compensation disclosures, we refer simply to "revenue" and "EPS," but we encourage you to review the information in Appendix A to understand the adjustments from reported revenue and EPS that were approved.

The Compensation Committee also has general authority to apply downward discretion to bonus, performance award, shareholder value award, and relative value award payouts for individual or all executive officers.

1.Base Salary

In setting salaries, Lilly seeks to retain, motivate, and reward successful performers while maintaining affordability within the company's business plan. Base salaries are reviewed and established annually and may be adjusted upon promotion, following a change in job responsibilities, or to maintain market competitiveness. Salaries are based on each person's level of contribution, responsibility, expertise, and competitiveness and are compared annually with peer group data.

Base salary increases for 2021 were based on competitiveness. Generally, executive base salaries are positioned against market salaries, considering experience and performance over time. If an executive's salary is deemed competitive given their experience and performance, no salary increase is provided.

2.Annual Cash Bonus

The Bonus Plan is designed to reward the achievement of the company’s annual financial and innovation objectives. All the named executive officers participated in the Bonus Plan during 2021. Mr. Van Naarden's participation in the Bonus Plan commenced at the time of his promotion on September 5, 2021. For the portion of the 2021 performance year prior to his promotion, Mr. Van Naarden participated in The Loxo Oncology, Inc. Bonus Plan (Loxo Bonus Plan), and in lieu of the payments he would have been eligible to receive thereunder, the Company paid Mr. Van Naarden a one-time payment, as further described below shows the minimum, target, and maximum payouts (using the grant date fair value) for the 2017-2019 performance awards included in the Summary Compensation Table.

|

| | | | |

| Name | Payout Date | Minimum Payout | Target Payout | Maximum Payout |

| Mr. Ricks | January 2019 | $0 | $3,400,000 | $5,100,000 |

| Mr. Conterno | January 2019 | $0 | $1,000,000 | $1,500,000 |

| Mr. Rice (retired) | January 2019 | $0 | $1,520,000 | $2,280,000 |

| Dr. Lundberg | January 2019 | $0 | $1,440,000 | $2,160,000 |

| Mr. Harrington | January 2019 | $0 | $920,000 | $1,380,000 |

Bonus Plan

The table below shows the minimum, target,Compensation Committee sets performance goals and maximum payouts (using the grant date fair value)individual bonus targets for the 2017-2019 shareholder value awards included in the Summary Compensation Table.

|

| | | | |

| Name | Payout Date | Minimum Payout | Target Payout | Maximum Payout |

| Mr. Ricks | January 2019 | $0 | $5,100,000 | $7,650,000 |

| Mr. Conterno | January 2019 | $0 | $1,500,000 | $2,250,000 |

| Mr. Rice (retired) | January 2019 | $0 | $2,280,000 | $3,420,000 |

| Dr. Lundberg | January 2019 | $0 | $2,160,000 | $3,240,000 |

| Mr. Harrington | January 2019 | $0 | $1,380,000 | $2,070,000 |

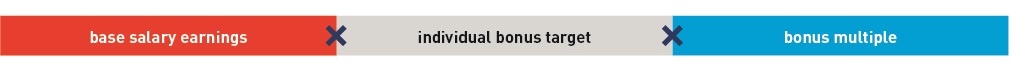

2 Payments under the Bonus Plan forat the beginning of each year. The bonus is based on three areas of company performance in each of the respective years. All bonuses paidmeasured relative to named executive officers were part of a non-equity incentive plan.internal targets: revenue, EPS, and pipeline progress. The annual cash bonus payout is calculated as follows:

3 The amounts in this column reflect the change in pension value for each individual, calculated by our actuary, and are affected by additional service accruals and pay earned, as well as actuarial assumption changes. The changes in pension values in 2017 were driven to a large extent by a lower discount rate which increased the net present value of pensions. The design of the pension benefit did not change. See the Pension Benefits in 2017 table below for information about the standard actuarial assumptions used. No named executive officer received preferential or above-market earnings on deferred compensation.

4 The amounts in this column are solely company matching contributions for each individual's 401(k) plan and nonqualified savings plan contributions. The company does not reimburse executives for taxes outside of the limited circumstance of taxes related to employee relocation or a prior international assignment. There were no reportable perquisites or personal benefits.

5 In 2015, the net present value of the pension benefits for Mr. Conterno and Mr. Rice reflect no change from the previous year due to an increase in the discount rate over the prior year. For the other named executive officers, increases in pensionable earnings offset the impact of the 2015 increased discount rate.

Grants of Plan-Based Awards During 2017

The compensation plans under which the grants in the following table were made are described in the CD&A and consist of the bonus plan (a non-equity incentive plan) and the 2002 Lilly Stock Plan (which provides for performance awards, shareholder value awards, and restricted stock units).

To receive a payout under the performance award or the shareholder value award, a participant must remain employed with the company through the end of the relevant award period (except in the case of death, disability, retirement, or redundancy). No dividends accrue on either performance awards or shareholder value awards during the performance period. Non-preferential dividends accrue during the 13-month service-vesting period (following the two-year performance period) and are paid upon vesting.

|

| | | | | | | | | | | | |

| Name | Award | | Grant Date2 | Compensation Committee Action Date | Estimated Future Payouts

Under Non-Equity

Incentive Plan Awards1 | Estimated Future

Payouts Under Equity

Incentive Plan Awards | All Other

Stock or Option Awards:

Number of

Shares of Stock,

Options, or Units | Grant Date

Fair Value

of Equity

Awards |

Threshold

($) | Target

($) | Maximum

($) | Threshold

(# shares) | Target

(# shares) | Maximum

(# shares) |

| Mr. Ricks | Annual Bonus | | __ | __ | $52,500 | $2,100,000 | $4,200,000 | | | | | |

| 2017-2019 PA | 3 | 2/9/2017 | 12/12/2016 | | | | 23,117 | 46,233 | 69,350 | | $5,100,000 |

| 2017-2019 SVA | 4 | 2/9/2017 | 12/12/2016 | | | | 39,045 | 78,089 | 117,134 | | $5,100,000 |

| | | | | | | | | | | 0 | |

| Mr. Conterno | Annual Bonus | | __ | __ | $15,240 | $609,601 | $1,219,203 | | | | | |

| 2017-2019 PA | 3 | 2/9/2017 | 12/12/2016 | | | | 6,799 | 13,598 | 20,397 | | $1,500,000 |

| 2017-2019 SVA | 4 | 2/9/2017 | 12/12/2016 | | | | 11,484 | 22,967 | 34,451 | | $1,500,000 |

| RSU | 5 | 12/11/2017 | 12/11/2017 | | | | | | | 34,615 | $3,000,000 |

| Mr. Rice (retired) | Annual Bonus | | __ | __ | $27,228 | $1,089,134 | $2,178,269 | | | | | |

| 2017-2019 PA | 3 | 2/9/2017 | 12/12/2016 | | | | 10,335 | 20,669 | 31,004 | | $2,280,000 |

| 2017-2019 SVA | 4 | 2/9/2017 | 12/12/2016 | | | | 17,455 | 34,910 | 52,365 | | $2,280,000 |

| | | | | | | | | | | 0 | |

| Dr. Lundberg | Annual Bonus | | __ | __ | $25,616 | $1,024,643 | $2,049,285 | | | | | |

| 2017-2019 PA | 3 | 2/9/2017 | 12/12/2016 | | | | 9,791 | 19,581 | 29,372 | | $2,160,000 |

| 2017-2019 SVA | 4 | 2/9/2017 | 12/12/2016 | | | | 16,537 | 33,073 | 49,610 | | $2,160,000 |

| | | | | | | | | | | 0 | |

| Mr. Harrington | Annual Bonus | | __ | __ | $17,123 | $684,904 | $1,369,808 | | | | | |

| 2017-2019 PA | 3 | 2/9/2017 | 12/12/2016 | | | | 6,255 | 12,510 | 18,765 | | $1,380,000 |

| 2017-2019 SVA | 4 | 2/9/2017 | 12/12/2016 | | | | 10,565 | 21,130 | 31,695 | | $1,380,000 |

| | | | | | | | | | | 0 | |

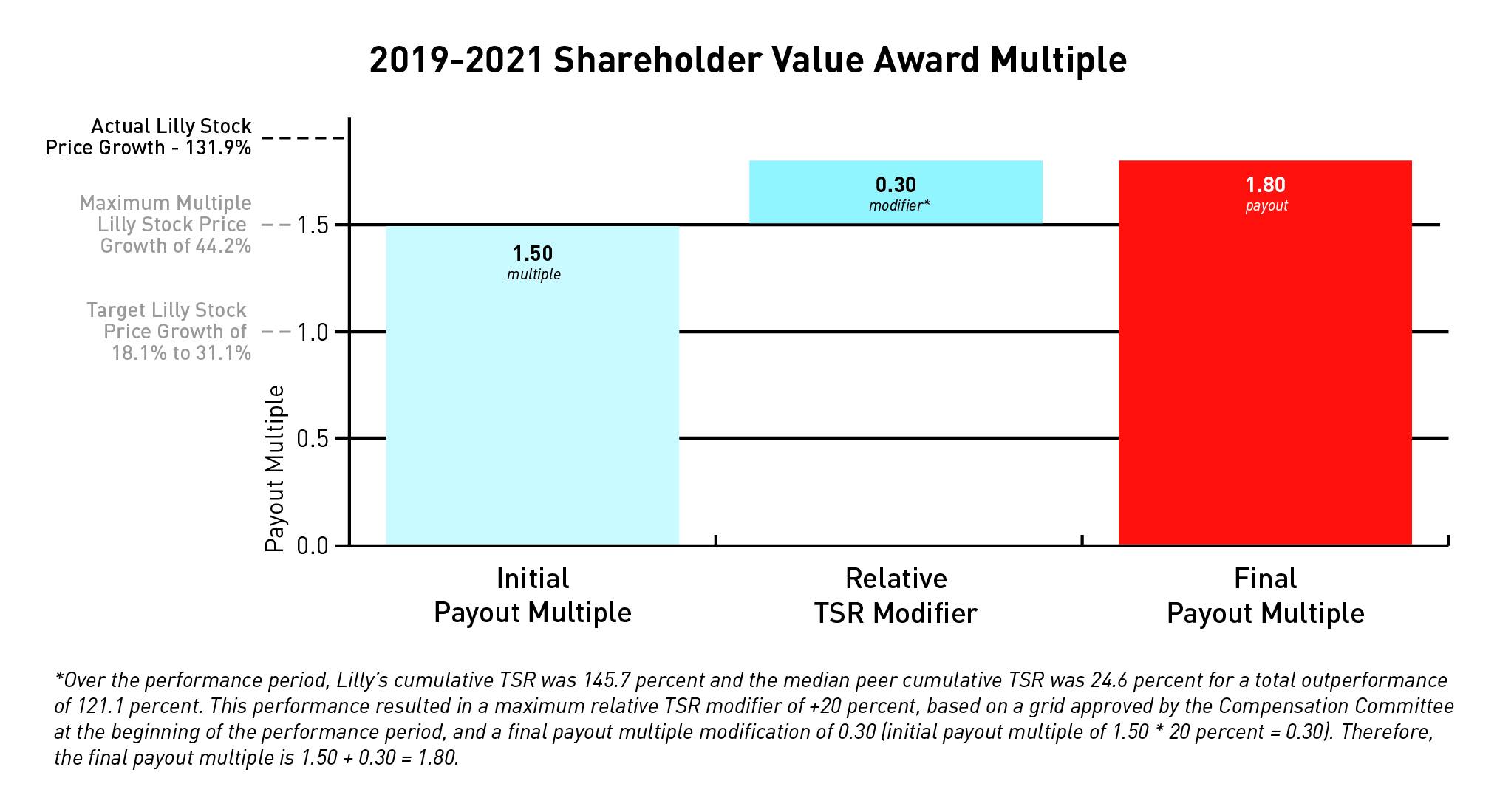

1 These columns show the threshold, target, and maximumActual payouts for performance under the Bonus Plan. Bonus payoutscan range from 0 to 200 percent of an individual's bonus target. The Compensation Committee references the annual operating plan and pipeline objectives to establish performance targets and to assess the relative weighting for each objective. In 2021, the weightings remain unchanged from the prior year:

| | | | | |

| Lilly Goals | Weighting |

| Revenue performance | 25% |

| EPS performance | 50% |

| Pipeline progress | 25% |

Based on this weighting, the company bonus paymentmultiple is calculated as follows:

Loxo Bonus Plan

Performance goals for 2017 performance was 134the Loxo Bonus Plan are determined by a committee consisting of senior company leadership (the Loxo Oncology Steering Committee) and mirror the goals under the Bonus Plan; provided, however, that eligible employees have an additional bonus opportunity that may be awarded for the attainment of other goals specific to oncology research and development (Additional Cash Award). These other goals can vary annually, but typically include preclinical, clinical, regulatory actions, external innovation and scientific publication milestones. These additional goals associated with molecule advancement and proof of concept milestones typically carry more weight in the Additional Cash Award results.

The annual Loxo Bonus Plan payout is calculated by multiplying a participant's base earnings, the individual bonus target and the sum of the Bonus Plan and Additional Cash Award payout multiples.

Base Earnings x Individual Bonus Target x (Bonus Plan Multiple + Additional Cash Award Multiple)

Actual payouts for the Loxo Bonus Plan can range from 0 to 400 percent of an individual's bonus target (0 to 200 percent for the Bonus Plan performance and 0 to 200 percent for the Additional Cash Award). Goal attainment is includeddetermined by the Loxo Oncology Steering Committee.

3.Equity Incentives

The company grants three types of equity incentives to executives and certain other employees: performance awards that are designed to focus leaders on multi‑year operational performance relative to peer companies, shareholder value awards that are intended to align earned compensation with long-term growth in shareholder value, and relative value awards which encourage TSR outperformance compared to our peer group. These awards, when considered together, align with shareholder interests by incenting long-term operational excellence, shareholder return and peer company outperformance without encouraging excessive risk-taking behaviors. The Compensation Committee has the discretion to adjust payout from an equity award granted to an executive officer downward from the amount yielded by the applicable formula.

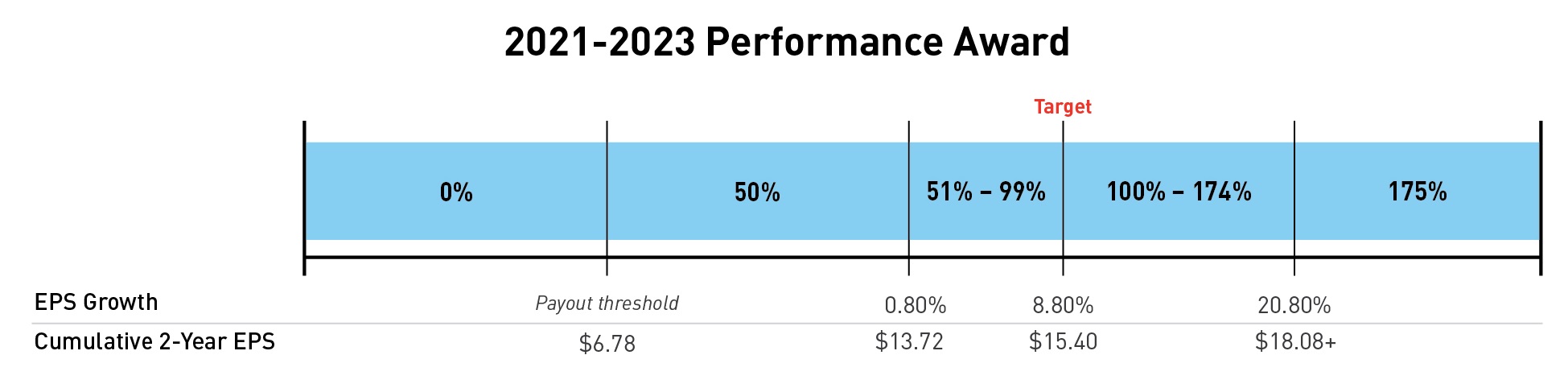

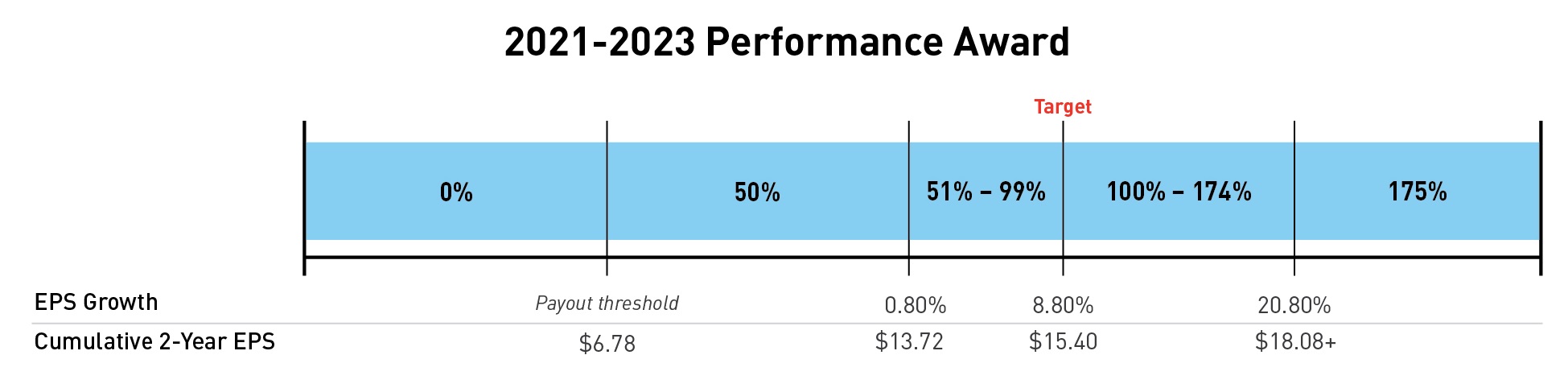

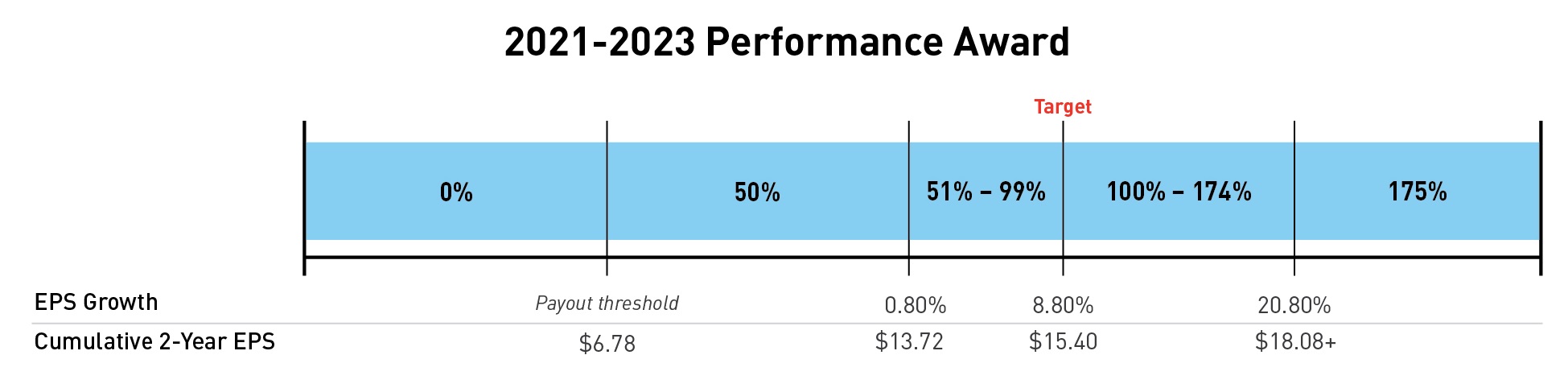

Performance Awards

Performance awards vest over three years. Payouts are based on achieving EPS growth targets over a two-year performance period, followed by an additional 13-month service-vesting period for executive officers. During the service-vesting period, the award is held in the form of restricted stock units. The growth-rate targets are set relative to the median external analyst anticipated EPS growth for our peer group over the same performance period. These awards do not accumulate dividends during the two-year performance period, but they do accumulate dividend equivalent units during the service-vesting period.

The Compensation Committee believes EPS growth is an effective measure of operational performance because it is closely linked to shareholder value, is broadly communicated to the public, is understood by Lilly employees, and allows for objective comparisons to the performance of Lilly's peer group. Consistent with the objectives established by the Compensation Committee, Lilly company performance exceeding the expected peer group median results in above‑target payouts, while Lilly company performance lagging the expected peer group median results in below‑target payouts. Possible payouts range from 0 percent to 175 percent of the target number of shares, depending on Lilly EPS growth over the performance period.

The measure of EPS used in the performance award program differs from the measure used in the Bonus Plan in two ways. First, the EPS goal in the Bonus Plan is set with reference to internal goals that align to our annual operating plan, while the EPS goal in the performance award program is set based on the external analyst anticipated EPS growth rates of our peer group. Second, the Bonus Plan measures EPS over a one-year period, while the performance award program measures EPS over a two-year period. In any given year, the Bonus Plan may pay above target while the performance award pays below target (or vice versa).

Shareholder Value Awards

Shareholder value awards are earned based on Lilly's share price performance. Shareholder value awards pay above target if Lilly's stock outperforms an expected rate of return and below target if Lilly's stock underperforms that expected rate of return. The expected rate of return is based on the three-year TSR that a reasonable investor would consider appropriate when investing in a basket of large-cap U.S. companies, as determined by the Compensation Committee. The minimum price to achieve target is calculated by multiplying the starting share price of Lilly's stock by the three-year compounded expected rate of return less Lilly's dividend yield. Shareholder value awards have a three-year performance period, and any shares paid are subject to a one-year holding requirement. No dividends are accrued during the performance period. Possible payouts are based on share price growth and range from 0 to 175 percent of the target number of shares. Executive officers receive no payout if Lilly's TSR for the three-year period is zero or negative.

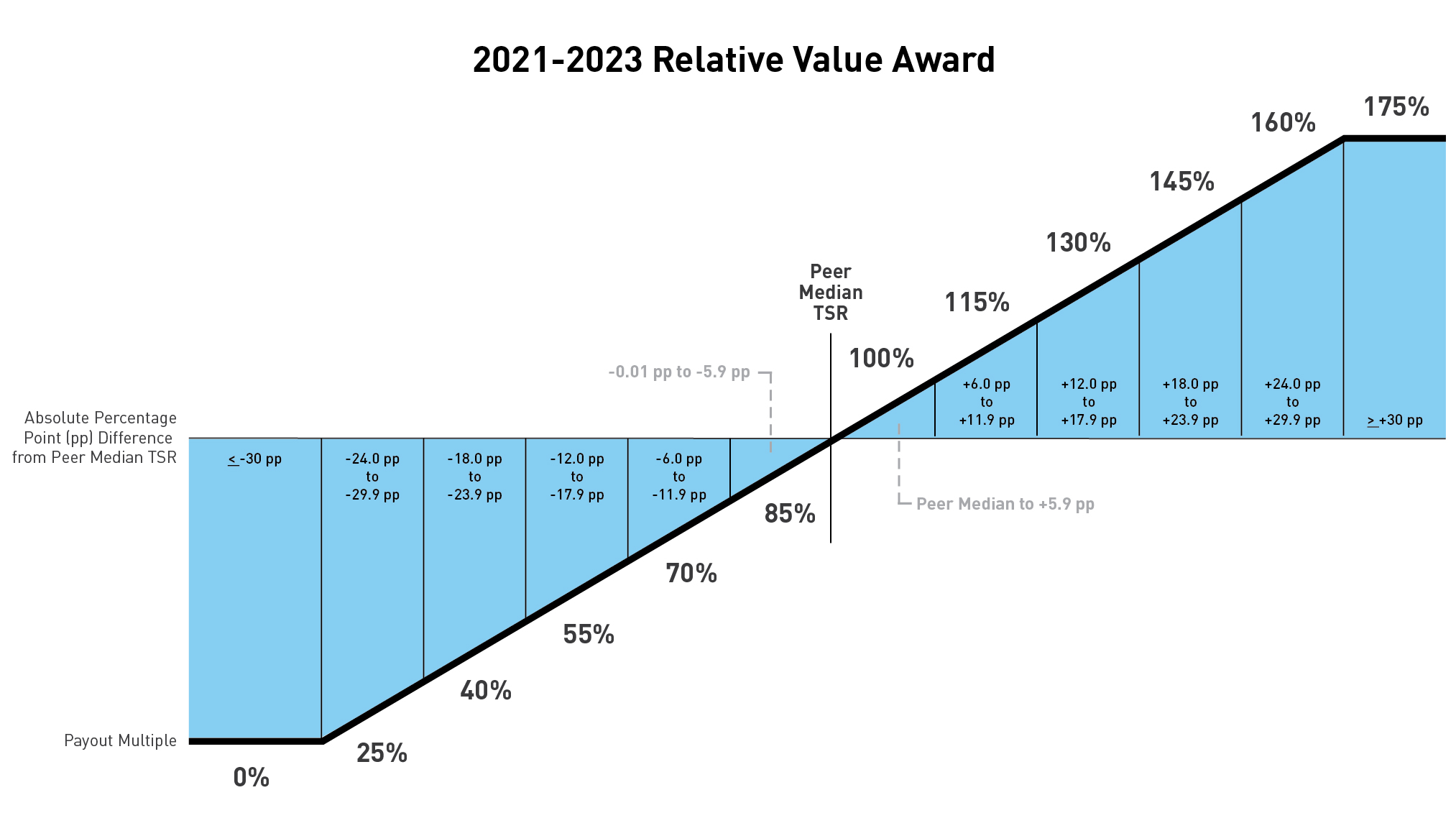

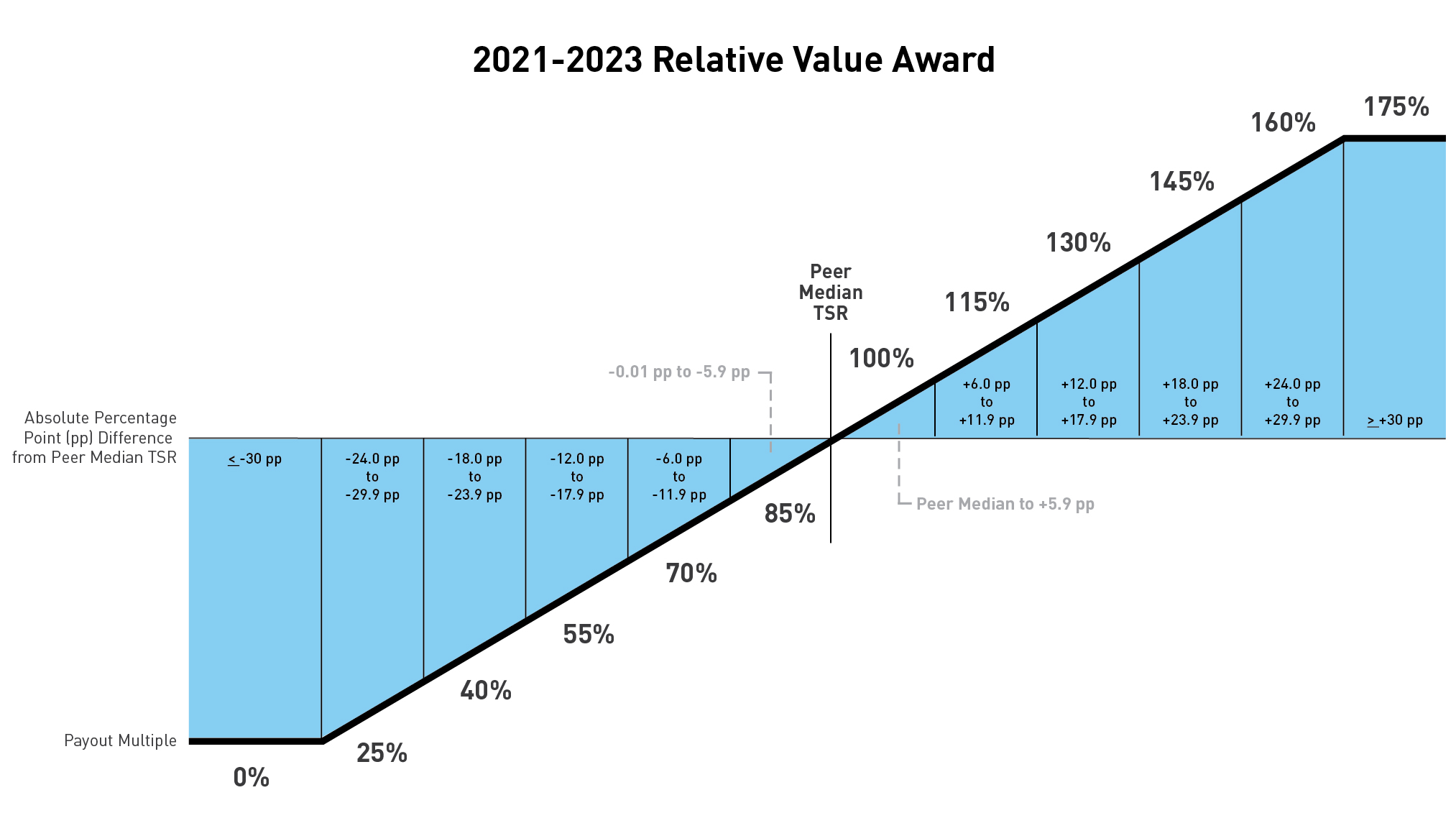

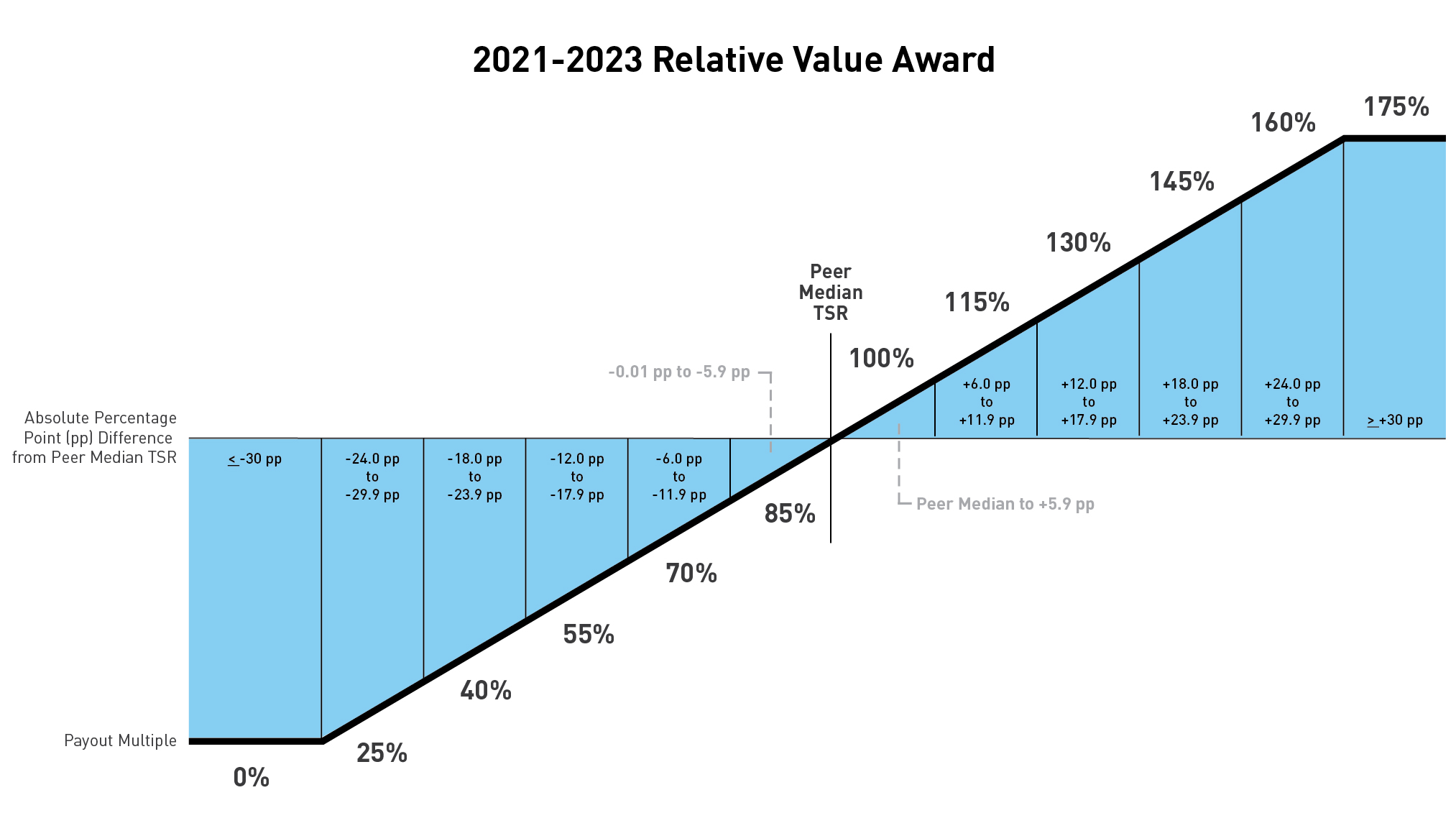

Relative Value Awards

Relative value awards are earned based on Lilly's TSR performance relative to our peer group. The minimum performance to achieve target is a TSR that is equal to the median TSR performance for the peer group. Relative value awards have a three-year performance period, and any shares paid are subject to a one-year holding requirement. No dividends are accrued during the performance period. Executive officers receive no payout if Lilly's TSR for the three-year period is 30 or more percentage points below the median TSR performance for the peer group over the same time period. Possible payouts range from 0 to 175 percent of the target number of shares.

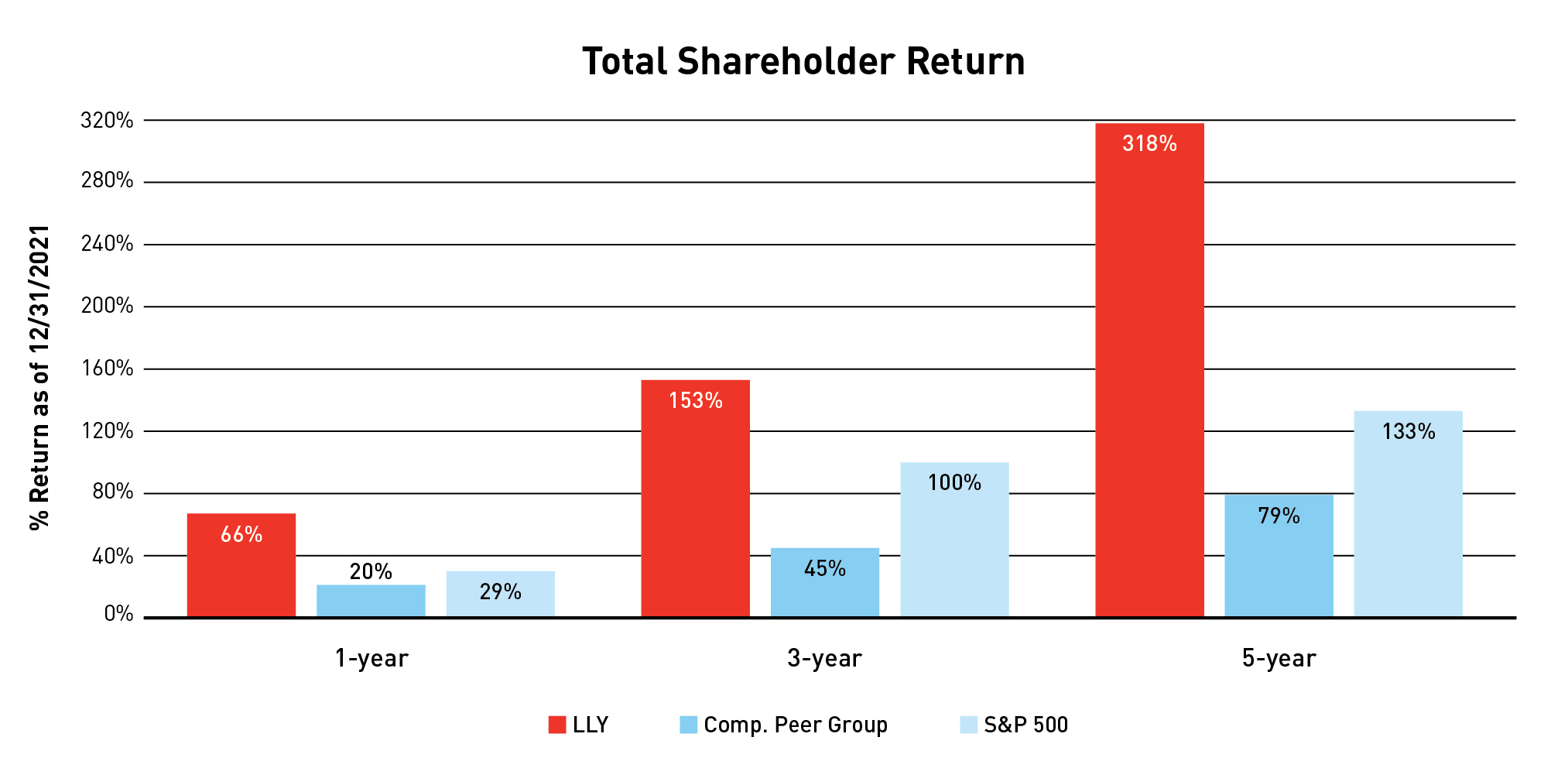

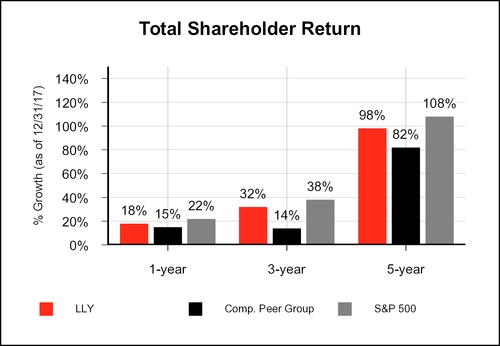

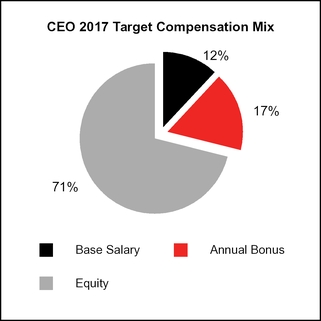

Pay for Performance

The mix of compensation for our named executive officers reflects Lilly’s desire to link executive compensation with individual and company performance. As reflected in the charts below, a substantial portion of the target pay for executive officers is performance-based. The annual cash bonus and equity payouts are contingent upon company performance, with the bonus factoring in performance over a one-year period, and equity compensation factoring in performance over multi-year periods. The charts below depict the annualized mix of target compensation for Lilly’s CEO and the average for the

other named executive officers annualized for Ms. Ashkenazi, Mr. Van Naarden and Mr. Rau. The Other Named Executive Officers chart below excludes Mr. Smiley.

Target Total Compensation

Performance Review Process

In setting 2021 target compensation for the named executive officers, the Compensation Committee considered individual contributions, Lilly's performance during 2020, internal relativity, peer group data, and input from the CEO for named executive officers other than himself.

Evaluation of Individual Named Executive Officer Performance

A summary of the Compensation Committee's review of individual named executive officer performance in 2020 that influenced decisions on 2021 target compensation for these executives is provided below:

David Ricks, Chair, President, and CEO:

In accordance with the company’s corporate governance guidelines, the independent directors conducted an assessment of Mr. Ricks’ performance led by the lead independent director. The independent directors believe the company largely met or exceeded its combined financial and strategic goals for 2020 under Mr. Ricks’ leadership. In 2020, Mr. Ricks and his team:

•Launched several innovative medicines to patients globally. Additionally, 25 new indications for already marketed medicines were launched to patients around the world

•Progressed 17 potential new medicines into Phase I clinical development from both internal research and external sources

•Initiated actions against the global COVID-19 pandemic, including (1) implementing diagnostic testing in our community, (2) discovering and developing SARS-CoV-2 neutralizing antibodies leading to the Emergency Use Authorization for bamlanivimab, and (3) striving to protect the health and safety of Lilly employees while continuing to provide life saving medicines

•Completed the acquisition of Dermira, expanded Lilly's strategic collaboration with Innovent for Tyvyt globally and completed seven preclinical asset transactions

•Continued to drive a cross-company productivity agenda resulting in savings that funded increased investment in research and development

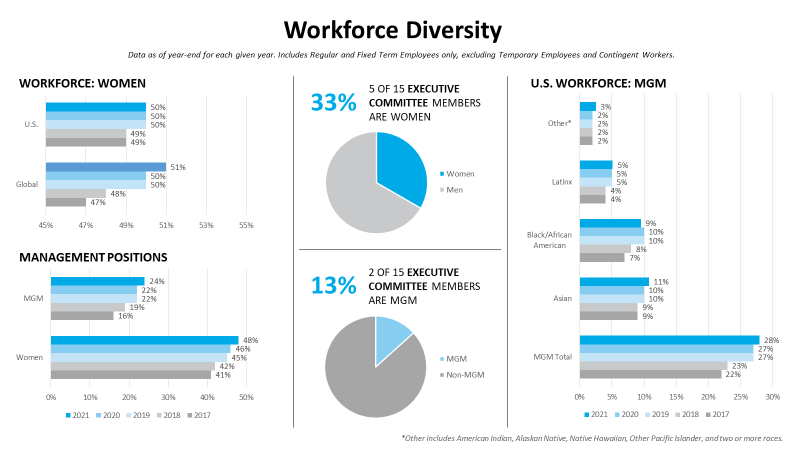

•Implemented a strategy that improved diversity, equity and inclusion across the company, increased the representation of women and minorities in management and conducted pay equity studies to promote equality in pay. The company was ranked #3 on the DiversityInc. top 50 companies list and received Women Business Collaborative CEO recognition for excellence in gender diversity

•Led the development of Lilly's comprehensive Racial Justice Commitment to help improve equity within Lilly and the communities in which it operates

•Achieved certain 2020 environmental performance goals first established in 2013, such as greenhouse gas emissions, energy efficiency, waste efficiency and wastewater

•Established new long-term goals for environmental, safety and governance goals for 2030

In addition, the company was named one of the world’s most ethical companies by the Ethisphere Institute.

Anat Ashkenazi, Senior Vice President and Chief Financial Officer:

Ms. Ashkenazi became Senior Vice President and Chief Financial Officer (CFO) on February 9, 2021. Prior to becoming CFO, Ms. Ashkenazi served as senior vice president and controller, and led corporate strategy at Lilly Research Laboratories. As controller, Ms. Ashkenazi:

•Played a key role in the company achieving its financial targets in 2020 and in the company’s efforts to reallocate financial resources in the fight against COVID-19

•Led the company’s broad productivity agenda for several years, having been a key partner to the operating units across the value cycle and played a key role in all business development activities

•Led the company’s 2021 strategic plan and 2021 operating plan

•Sponsors Lilly’s Veteran Network, an employee resource group focused on recruiting and advancing people who served in the country’s military

Daniel Skovronsky, M.D., Ph.D., Senior Vice President, Chief Scientific and Medical Officer and President, Lilly Research Laboratories:

Dr. Skovronsky advanced innovation for patients as the company's chief scientific and medical officer. His contributions in 2020 include:

•Advanced innovative medicines through the product pipeline leading to numerous first approvals, including bamlanivimab (under Emergency Use Authorization from the FDA) in partnership with AbCellera. Additionally, 25 new indications for already-marketed medicines were launched to patients globally

•Achieved several significant positive data readouts for Verzenio (Phase III in the adjuvant setting), LOXO-305 (advanced b-cell malignancies), Jardiance (cardiovascular outcomes in heart failure with reduced ejection fraction), mirikizumab (psoriasis head-to-head versus secukinumab) and tirzepatide (type 2 diabetes)

•Co-led the acquisition of Dermira, expanded Lilly's strategic collaboration with Innovent for Tyvyt globally, and completed seven preclinical asset transactions

•Sped research resulting in 17 potential new medicines advancing to Phase I clinical development including both internally discovered molecules and molecules sourced externally via business development

•Led the company’s efforts in the fight against SARS-CoV-2 including (1) implementing diagnostic testing at our headquarters in Indianapolis, Indiana and (2) discovering and developing SARS-CoV-2 neutralizing antibodies leading to the Emergency Use Authorization for bamlanivimab

•Enhanced strategies to further reduce drug discovery and development timelines, leading to earlier product launch

•Led DEI strategies in research and development to improve innovation and productivity.

Jacob Van Naarden, Senior Vice President, CEO Loxo Oncology at Lilly and President, Lilly Oncology:

Mr. Van Naarden served as chief operating officer of Loxo Oncology at Lilly when the company acquired Loxo Oncology, Inc. in 2019 and was later named CEO of Loxo Oncology at Lilly in January 2021. Mr. Van Naarden played an integral role with numerous oncology assets including the approval of Retevmo. As CEO of Loxo Oncology at Lilly, Mr. Van Naarden has built a science-first drug discovery and development organization. He has led numerous business development transactions and contributed to the company’s scientific efforts in other therapeutic areas.

Diogo Rau, Senior Vice President and Chief Information and Digital Officer:

Mr. Rau joined Lilly as senior vice president and chief information and digital officer in May 2021. Prior to joining Lilly, Mr. Rau served as senior director of information systems and technology for retail and online stores and most recently served as the top executive of information technology for retail and online stores at Apple, Inc. (Apple). During his 10 years at Apple, he led the development and implementation of the technology supporting the Apple Online Store and Apple retail stores,

including e-commerce platform, mobile point of sale, the Apple Store App, and systems used by store team members. Prior to joining Apple, Mr. Rau was a partner with McKinsey & Company.

In connection with Mr. Smiley’s resignation as an officer on February 9, 2021, the Compensation Committee took action to reduce his 2020 Bonus Plan payout to zero, reduce his 2018-2020 shareholder value award and cancel all his other outstanding equity incentive awards granted in 2019 and 2020. The foregoing terms were agreed to by Mr. Smiley pursuant to his release agreement effective as of February 9, 2021. The material terms of the agreement were previously disclosed in the company’s 2021 proxy statement.

Target Compensation

The information below reflects total compensation at target for named executive officers for 2021. The actual compensation received is summarized below in "Compensation Results."

Rationale for Changes to Named Executive Officer Target Compensation

The Compensation Committee established the 2021 target total compensation for each named executive officer, except Ms. Ashkenazi, Mr. Van Naarden and Mr. Rau, based on the named executive officer's 2020 performance, internal relativity, and peer group data. The Compensation Committee approved target total compensation for Ms. Ashkenazi, Mr. Van Naarden and Mr. Rau upon their promotion or hire, as applicable, based on job scope, market data, experience, and internal relativity.

Base Salary

The following table shows the approved annualized salary for each named executive officer. Mr. Ricks and Dr. Skovronsky did not receive an adjustment to base pay in 2021, and the remaining executive officers' 2021 annualized salaries were effective on the day they assumed their new responsibilities. Each named executive officer's actual base salary earned during 2021 is reflected in the Summary Compensation Table in the column titled “Non-Equity Incentive Plan Compensation.”"Executive Compensation" section of this proxy statement.

| | | | | | | | | | | | | | | | | |

Name2 | 2020 Annual Base Salary Effective March 1, 2020 | 2021 Annual Base Salary Effective March 7, 2021 | Increase |

| Mr. Ricks | $1,500,000 | | $1,500,000 | | 0 | % |

| Ms. Ashkenazi | N/A | 1 | $900,000 | | N/A |

| Dr. Skovronsky | $1,000,000 | | $1,000,000 | | 0 | % |

| Mr. Van Naarden | N/A | 1 | $675,000 | | N/A |

| Mr. Rau | N/A | 1 | $670,000 | | N/A |

1 Ms. Ashkenazi, Mr. Van Naarden and Mr. Rau were not named executive officers in 2020.

2 For the period beginning on January 1, 2021 through February 8, 2021, Mr. Smiley's annual base salary was $1,000,000, and for the transition period beginning on February 9, 2021 through July 31, 2021, Mr. Smiley earned a biweekly base salary of $9,000.

2 To assure grant timing is not manipulated for employee gain, the annual grant date is established in advance byAnnual Cash Bonus Targets

Based on a review of internal relativity, peer group data, and individual performance, the Compensation Committee. Equity awardsCommittee retained the same percent-of-salary bonus target as in 2020 for Mr. Ricks, increased the bonus target for Dr. Skovronsky to new hires100 percent, set Ms. Ashkenazi's bonus target at 100 percent, and other off-cycle grantsset Mr. Van Naarden's and Mr. Rau's bonus targets at 80 percent. Bonus targets are generally effective onshown in the first trading daytable below as a percentage of the following month.each named executive officer’s earnings from base salary in 2021:

| | | | | | | | | | | | | | |

Name3 | 2020 Bonus Target | 2021 Bonus Target |

| Mr. Ricks | 150 | % | | 150 | % | |

| Ms. Ashkenazi | N/A | 1 | 100 | % | |

| Dr. Skovronsky | 95 | % | | 100 | % | |

| Mr. Van Naarden | N/A | 1 | 80 | % | 2 |

| Mr. Rau | N/A | 1 | 80 | % | 2 |

1 Ms. Ashkenazi, Mr. Van Naarden and Mr. Rau were not named executive officers in 2020.

2 Mr. Van Naarden's Bonus Plan participation was initiated upon his promotion on September 5, 2021. Prior to his promotion, Mr. Van Naarden participated in the Loxo Bonus Plan, which entitled him to a target bonus equal to 60% of base salary.

3This row shows Pursuant to the possible payoutsterms of his separation agreement with the company, Mr. Smiley was not entitled to an annual bonus for 2017-2019the 2020 and 2021 calendar years. See "Agreement with Former Chief Financial Officer" for additional information.

Equity Incentives - Target Grant Values

For 2021 equity grants, the Compensation Committee set the total target values for named executive officers based on market data, individual performance, award grants ranging from 0 to 150and internal relativity. Named executive officers have 35 percent of target. Thistheir equity target allocated to shareholder value awards and relative value awards, respectively, and 30 percent to performance awards. Total target values for the 2020 and 2021 equity grants to the named executive officers were as follows:

| | | | | | | | | | | | | | |

Name5 | 2020 Annual Equity Grant | 2021 Annual Equity Grant |

| Mr. Ricks | $12,500,000 | | $14,000,000 | |

| Ms. Ashkenazi | N/A | 1 | $2,200,000 | 2 |

| Dr. Skovronsky | $4,100,000 | | $4,700,000 | |

| Mr. Van Naarden | N/A | 1 | $1,300,000 | 3 |

| Mr. Rau | N/A | 1 | N/A | 4 |

1 Ms. Ashkenazi, Mr. Van Naarden and Mr. Rau were not named executive officers in 2020.

2 Ms. Ashkenazi’s 2021 award will pay out in January 2020. The grant-date fair value ofwas granted prior to her transition into the performance award reflectsChief Financial Officer role. As such, her 2021 annual equity grant aligns with the probable payout outcome anticipatedterms and conditions associated with her prior position.

3 Mr. Van Naarden was not an executive officer at the time of the 2021 annual equity grant. As such, his 2021 annual equity grant aligns with the terms and conditions associated with his prior position. Mr. Van Naarden also received equity awards of restricted stock units valued at (i) $1,650,000 in February 2021 representing transition equity following Lilly’s acquisition of Loxo Oncology, Inc. and (ii) $1,000,000 in December 2021 associated with Mr. Van Naarden's promotion.

4 Mr. Rau started with Lilly in May 2021, after annual grants were issued; however, he received an equity grant of restricted stock units valued at $4,000,000 upon hire to replace a portion of the outstanding equity he forfeited after leaving Apple and the missed opportunity for a 2021 annual equity award from Lilly.

5 Pursuant to the terms of his separation agreement with the company, Mr. Smiley was not entitled to an annual equity grant in 2021. See "Agreement with Former Chief Financial Officer" for additional information.

Performance Goals for Incentive Programs

Annual Cash Bonus Goals

The Compensation Committee established the company performance targets using the company's 2021 annual operating plan, which was greater thanapproved by the board in 2020. These targets are described below under "Compensation Results."

Performance Award

In February 2021, the Compensation Committee established a compounded two-year EPS growth target of 8.8 percent per year based on investment analysts’ EPS growth estimates for our peer group companies at that time. To translate the 8.8 percent per year growth goal into a two-year cumulative EPS target, the Compensation Committee applied the target value.

4 This row showsgrowth to the range2020 adjusted non-GAAP EPS of payouts$6.78 to obtain target 2021 results of $7.38 and then applied the goal growth again to the target 2021 results to obtain target 2022 results of $8.02. The target 2021 and 2022 results were added together to yield a two-year cumulative EPS target of $15.40. Payouts for 2017-2019 shareholder valuethe 2021-2023 performance award grants. This shareholder value award will pay out in January 2020, with payouts rangingcan range from 0 to 150175 percent of target. We measure the fair valuetarget number of shares, as shown below:

Shareholder Value Award

For purposes of establishing the stock price target for the shareholder value award onawards, the grant date using a Monte Carlo simulation model.

5 Mr. Conterno received a special retention grant in recognition of his leadership in delivering the company's strategy and providing continuity in a time of significant transition at the company. The award will vest on December 11, 2021, and it will be forfeited if Mr. Conterno resigns or retires from the company prior to that date.

Outstanding Equity Awards at December 31, 2017

The 2017 closing stockstarting price used to calculate the values in the table below was $84.46.

|

| | | | | | | | | |

| | Stock Awards1 |

| Name | Award | Number of

Shares or

Units of Stock

That Have Not

Vested (#) | Market

Value of

Shares or

Units of

Stock That

Have Not

Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units, or Other Rights That Have Not Vested (#) | Equity Incentive

Plan Awards:

Market or

Payout Value of Unearned

Shares, Units,

or Other Rights

That Have Not

Vested ($) |

| Mr. Ricks | 2017-2019 SVA | | | | 140,561 |

| 2 | $11,871,782 |

| | 2016-2018 SVA | | | | 57,797 |

| 3 | $4,881,535 |

| | 2017-2019 PA | | | | 69,350 |

| 4 | $5,857,301 |

| | 2016-2018 PA | 12,222 |

| 5 | $1,032,270 | | | |

| | 2015-2017 PA | 21,326 |

| 6 | $1,801,194 | | | |

| Mr. Conterno | 2017-2019 SVA | | | | 41,341 |

| 2 | $3,491,661 |

| | 2016-2018 SVA | | | | 57,797 |

| 3 | $4,881,535 |

| | 2017-2019 PA | | | | 20,397 |

| 4 | $1,722,731 |

| | 2016-2018 PA | 12,222 |

| 5 | $1,032,270 | | | |

| | 2015-2017 PA | 21,326 |

| 6 | $1,801,194 | | | |

| | 2008 RSU Award | 20,000 |

| 7 | $1,689,200 | | | |

| | 2017 RSU Award | 34,615 |

| 8 | $2,923,583 | | | |

| Mr. Rice (retired) | 2017-2019 SVA | | | | 62,838 |

| 2 | $5,307,297 |

| | 2016-2018 SVA | | | | 99,830 |

| 3 | $8,431,642 |

| | 2017-2019 PA | | | | 31,004 |

| 4 | $2,618,598 |

| | 2016-2018 PA | 21,111 |

| 5 | $1,783,035 | | | |

| | 2015-2017 PA | 40,518 |

| 6 | $3,422,150 | | | |

| Dr. Lundberg | 2017-2019 SVA | | | | 59,532 |

| 2 | $5,028,073 |

| | 2016-2018 SVA | | | | 94,576 |

| 3 | $7,987,889 |

| | 2017-2019 PA | | | | 29,372 |

| 4 | $2,480,759 |

| | 2016-2018 PA | 20,000 |

| 5 | $1,689,200 | | | |

| | 2015-2017 PA | 36,252 |

| 6 | $3,061,844 | | | |

| Mr. Harrington | 2017-2019 SVA | | | | 38,034 |

| 2 | $3,212,352 |

| | 2016-2018 SVA | | | | 60,423 |

| 3 | $5,103,327 |

| | 2017-2019 PA | | | | 18,765 |

| 4 | $1,584,892 |

| | 2016-2018 PA | 12,778 |

| 5 | $1,079,230 | | | |

| | 2015-2017 PA | 24,524 |

| 6 | $2,071,297 | | | |

1 The chart no longer includes stock option awards because the company has not awarded stock options to employees since 2006 and there are no outstanding stock option awards.

2 Shareholder value awards granted for the 2017-2019 performance period will vest on December 31, 2019. The number of shares reported reflects the maximum payout, which will be made if$152.16 per share, the average closing stock price for all trading days in November and December 20182020. The target share price was established using the expected annual rate of return for large-cap companies (8 percent), less an assumed Lilly dividend yield (2.23 percent). To determine payout, the ending price will be the average closing price of company stock for all trading days in November and December 2023. The award is designed to deliver no payout to executive officers if the shareholder return (including projected dividends) is zero or negative. Possible payouts based on share price ranges are illustrated in the grid below.

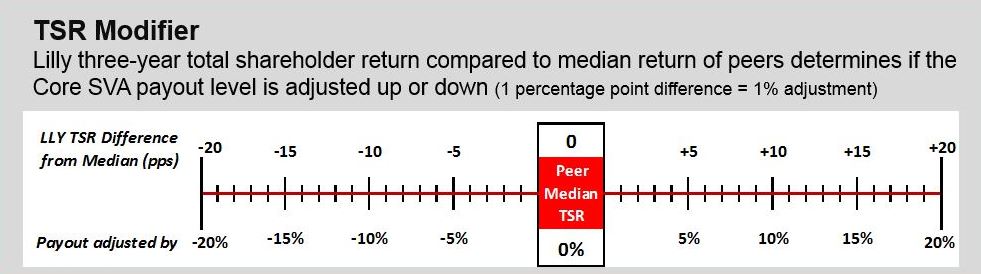

Relative Value Award

The relative value award is based on the three-year Lilly TSR performance compared to our peer group. To determine payout, the TSR performance is calculated for Lilly and its peers. This calculation compares the average closing price of each company’s stock for all trading days in November and December 2020 to the average closing price of each company’s stock for all trading days in November and December 2023, assuming reinvestment of dividends, to obtain the TSR for each company. The median TSR for the peer companies is then subtracted from Lilly’s TSR to determine what payout has been earned. For example, if Lilly’s TSR was 55 percent over $101.79. Actual payouts may varythe three-year performance period and the median peer company performance was 41 percent, Lilly would have outperformed by 14 percentage points (55 percent - 41 percent). This outperformance would have resulted in a 130 percent payout based on the payout ranges depicted below.

Compensation Results

The information in this section reflects the amounts paid to named executive officers under the Bonus Plan and for equity awards granted in prior years for which the relevant performance period ended in 2021.

Lilly Performance

In 2021, we exceeded our revenue target and nearly achieved our EPS target. We also made significant pipeline advances. Key pipeline highlights include U.S. approval of a new indication for Verzenio® for certain people with high-risk, early breast cancer; the Emergency Use Authorization for the administration of bamlanivimab and etesevimab together for the treatment

of COVID-19 in patients at high risk for hospitalization; the regulatory submission for tirzepatide for type 2 diabetes in the U.S. to which Lilly applied a priority review voucher, as well as submission in Europe and Japan; positive topline results from donanemab’s TRAILBLAZER-ALZ, a Phase II study evaluating the efficacy and safety of donanemab compared to placebo in patients with early symptomatic Alzheimer’s disease; updated data for pirtobrutinib, from the LOXO-305 BRUIN Phase I/II clinical trial in mantle cell lymphoma and other non-Hodgkin lymphomas, as well as in chronic lymphocytic leukemia and small lymphocytic lymphoma, at the 2021 American Society of Hematology Annual Meeting; positive topline results from mirikizumab’s Phase III LUCENT-1 and 2 studies evaluating the efficacy and safety of mirikizumab compared to placebo for the treatment of patients with moderately-to-severely active ulcerative colitis; and positive topline results from three studies of lebrikizumab’s Phase III program evaluating the efficacy and safety of lebrikizumab in people with moderate-to-severe atopic dermatitis. See "Proxy Statement Summary—Highlights of 2021 Performance."

By the end of 2021, Lilly exceeded its two-year EPS growth target for the performance award and our three-year stock price growth target for the shareholder value award. The company began granting relative value awards in 2020; therefore, no relative value awards were granted or earned for the 2019-2021 performance period. The discussion below details the measures used in each program, what the performance goal was to obtain target performance, how performance outcomes were assessed and what the Compensation Committee approved as the final payout multiple.

Bonus Plan

The company utilized revenue, EPS, and pipeline progress to incent the achievement of 2021 company objectives. Each measure contributes to the final payout multiple on a weighted basis: revenue (25 percent), EPS (50 percent), and pipeline progress (25 percent). Each performance measure is assessed a payout multiple of 0 to 200 percent.

For purposes of the bonus, the Compensation Committee adjusted revenue and non-GAAP EPS to exclude estimated savings from certain discrete and unplanned performance items from the bonus plan multiple. The Science and Technology Committee's assessment of the company's product pipeline achievements is detailed below:

| | | | | | | | |

| Activity | Objective | Achievement |

| Approvals | 2 new drug first approvals

14-15 other approvals | 0 new drug first approvals

18 other approvals |

| Potential new drug Phase III starts | 3 | 2 |

| Potential new drug Phase I starts | 16-17 | 12 |

| Potential new indication or line extension Phase III starts | 5 | 9 |

| Plan Boldly | Meet industry benchmark for speed of development | Exceeded industry benchmark for speed of development |

| Deliver to Launch | Meet planned project timelines | Met planned project timelines |

| Qualitative Assessment | Assessment of the chief scientific and medical officer's evaluation of performance against strategic objectives |

Based on the recommendation of the Science and Technology Committee, the Compensation Committee approved a pipeline multiple of 1.06.

The company's performance compared to targets as well as the resulting bonus multiple, is illustrated below:

For additional information on financial results, see Appendix A, "Summary of Adjustments Related to the Annual Cash Bonus and Performance Award."

When combined, the revenue, EPS, and pipeline multiples yielded a bonus multiple of 1.10.

Loxo Bonus

The Loxo Bonus Plan Committee assessed the level of oncology research and development goal achievement compared to the preclinical, clinical, regulatory actions, external innovation and scientific disclosure milestones established at the beginning of the year. On a payout continuum between 0 – 200 percent, the Loxo Bonus Plan Committee determined the Additional Cash Award portion of the Loxo Bonus would pay at 200 percent. To determine the final Loxo Bonus payout multiple, the Loxo Bonus Plan Committee added the Bonus Plan multiple to the Additional Cash Award multiple to yield a total payout of 310 percent.

Bonus Payments

The 2021 bonuses paid to the applicable named executive officers under the Bonus Plan were as follows:

| | | | | | | | |

Name3 | 2021 Bonus ($) |

| Mr. Ricks | $2,475,000 | |

| Ms. Ashkenazi | $907,816 | |

| Dr. Skovronsky | $1,100,000 | |

Mr. Van Naarden1 | $1,029,507 | |

Mr. Rau2 | $362,831 | |

1 A portion of the 2021 bonus payable to Mr. Van Naarden was attributable to achievement of the performance goals under the Loxo Bonus Plan. The 2021 Loxo Bonus Plan achievement was 310%. The amount of the 2021 bonus paid to Mr. Van Naarden in the table above reflects his achievement under both the Loxo Bonus Plan and the Bonus Plan, in each case, pro-rated to reflect the period in 2021 during which he was a participant in the respective plan. Mr. Van Naarden also received a one-time cash payment of $218,715 in lieu of compensation and benefits he was no longer eligible to receive following his transition to his new role, including compensation for the difference between the bonus he would have earned under the Loxo Bonus Plan and the Lilly Bonus Plan, and changes in his expected out-of-pocket costs for healthcare expenses.

2 Mr. Rau joined Lilly in May 2021, and the table reflects the pro-rated bonus paid for the portion of the year for which he was employed.

3 Pursuant to the terms of his separation agreement with the company, Mr. Smiley was not entitled to an annual bonus for calendar year 2021. See "Agreement with Former Chief Financial Officer" for additional Information.

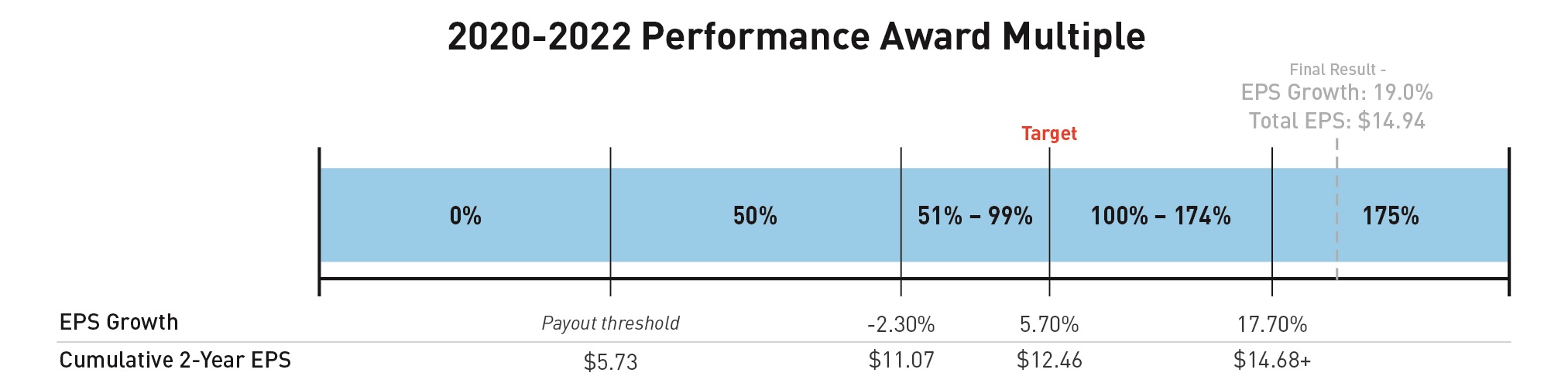

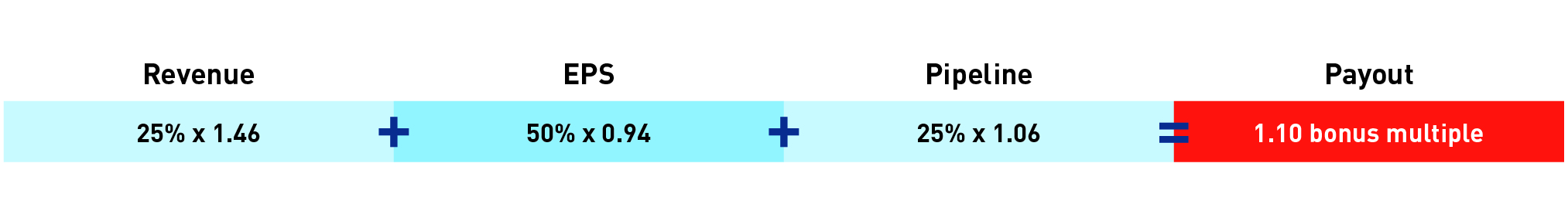

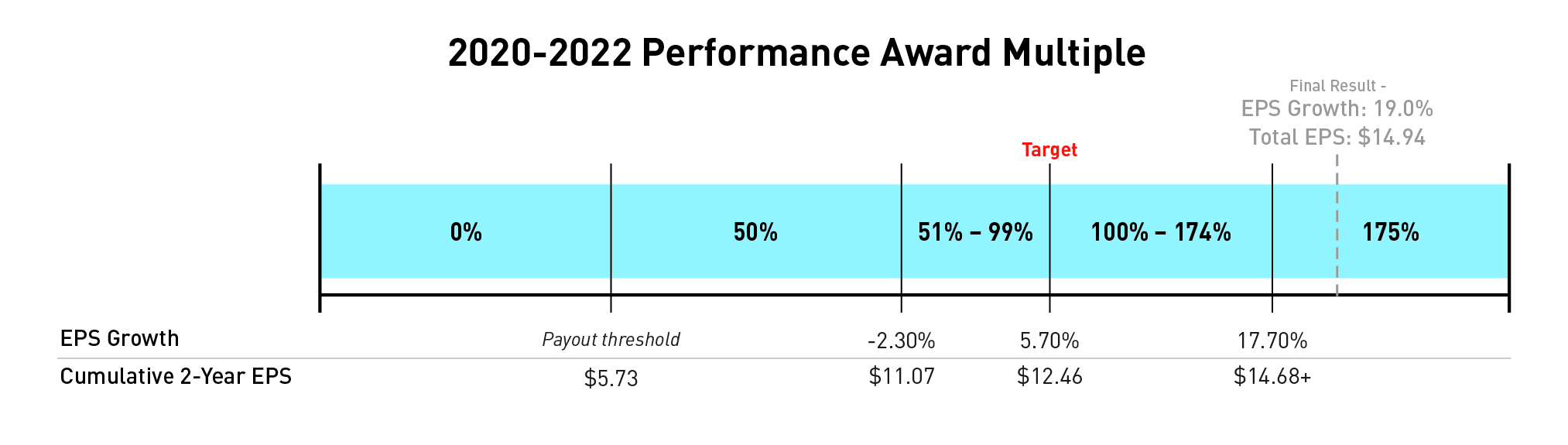

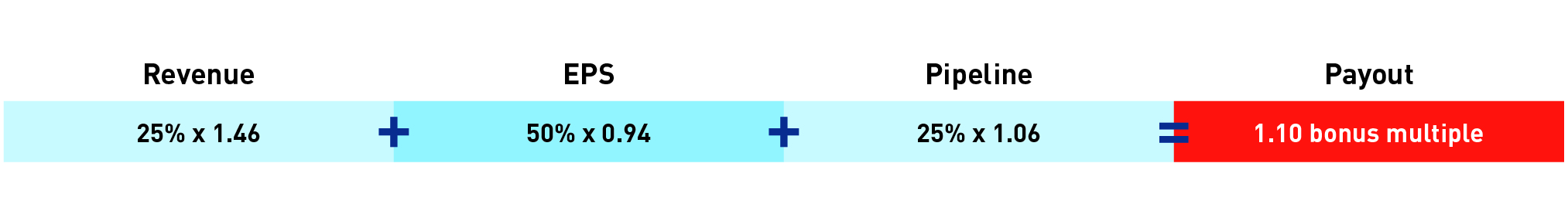

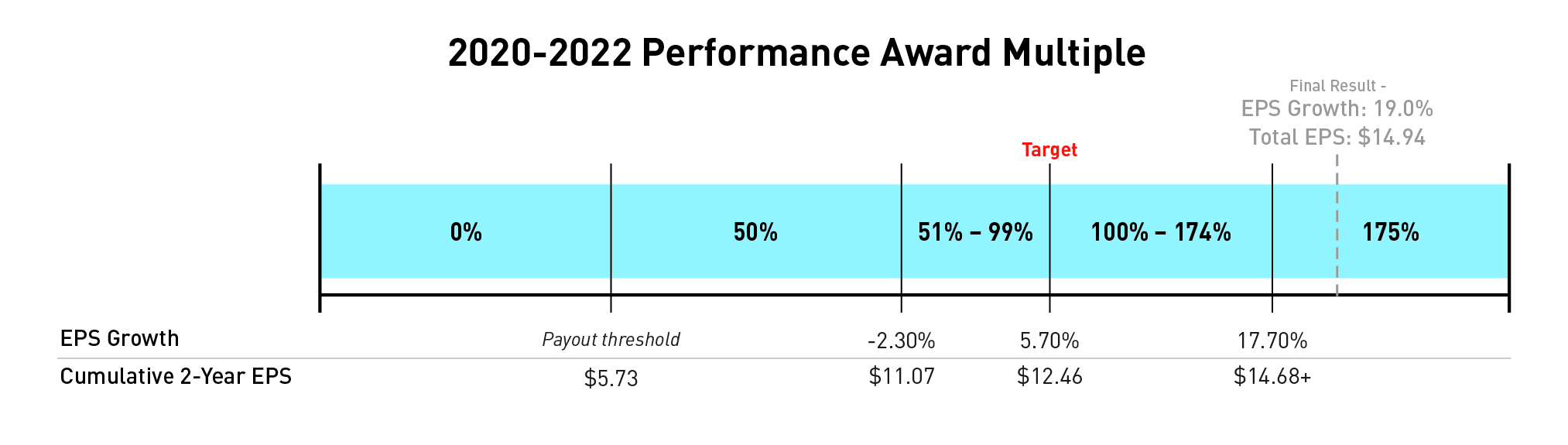

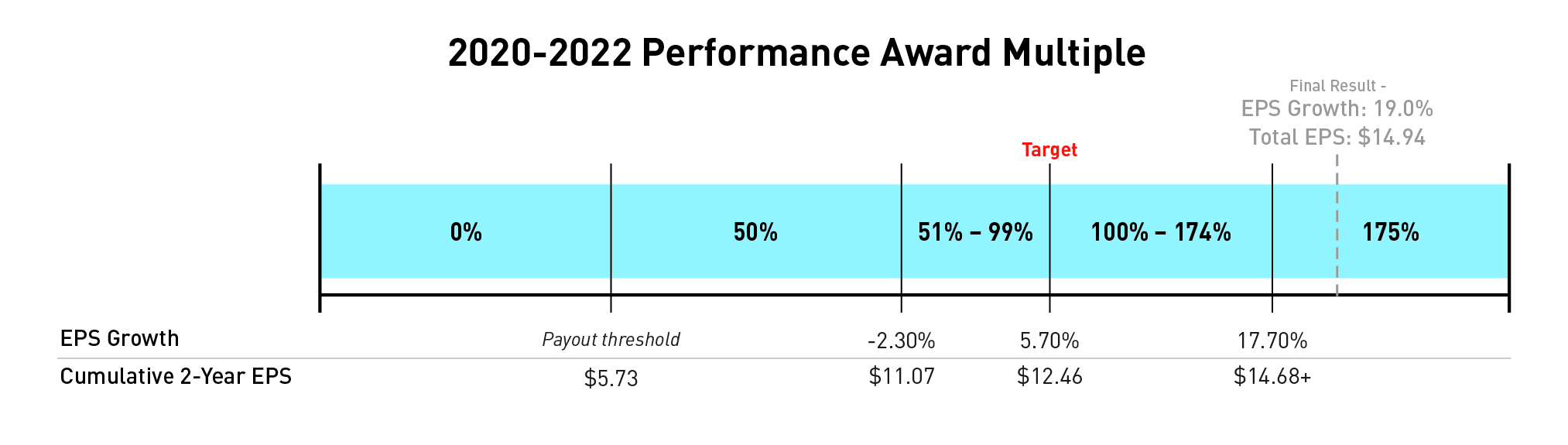

2020-2022 Performance Awards

The target cumulative EPS for the 2020-2022 performance award was originally set in the first quarter of 2020, reflecting expected peer group EPS growth of 5.7 percent each year and a total target EPS of $13.13 over the two-year performance period. In December 2020, the Compensation Committee updated the award to align with Lilly's decision to adjust EPS results to remove the impact of gains and losses on investments in equity securities from its non-GAAP measures and compensation program outcomes. The updated award retained the Compensation Committee's decision to establish a compounded two-year EPS growth target of 5.7 percent per year, but the growth was applied to an adjusted 2019 non-GAAP EPS of $5.73 that excluded gains and losses on investments in equity securities. Using this methodology, the adjusted EPS target became $12.46 for the two-year performance period of 2020-2021. The company's actual adjusted EPS over the performance period was $14.94 representing a growth rate of 19.0 percent.

For Mr. Ricks and Dr. Skovronsky, shares earned for the 2020-2021 performance period are subject to an additional 13-month service-vesting period and are shown in the table below as restricted stock units. Because she was not an executive officer when the award was granted, Ms. Ashkenazi's 2020-2021 performance award was paid in shares of Lilly common stock and not subject to the additional service-vesting period. Mr. Van Naarden was an employee of Loxo Oncology, Inc. and did not receive a performance award grant in 2020. Mr. Rau joined Lilly in May 2021, so he did not receive a performance award grant in 2020.

| | | | | | | | | | | |

Name3 | Target Shares | Shares Earned | RSUs |

| | | |

| Mr. Ricks | 27,306 | N/A | 47,786 |

| Ms. Ashkenazi | 2,731 | 4,779 | N/A |

| Dr. Skovronsky | 8,957 | N/A | 15,675 |

Mr. Van Naarden1 | N/A | N/A | N/A |

Mr. Rau2 | N/A | N/A | N/A |

1 Mr. Van Naarden was an employee of Loxo Oncology, Inc. and did not receive a performance award grant in 2020.

2 Mr. Rau joined Lilly in May 2021, so he did not receive a performance award grant in 2020.

3 Pursuant to the terms of his separation agreement with the company, Mr. Smiley forfeited his entire 2020-2022 performance award. See "Agreement with Former Chief Financial Officer" for additional information.

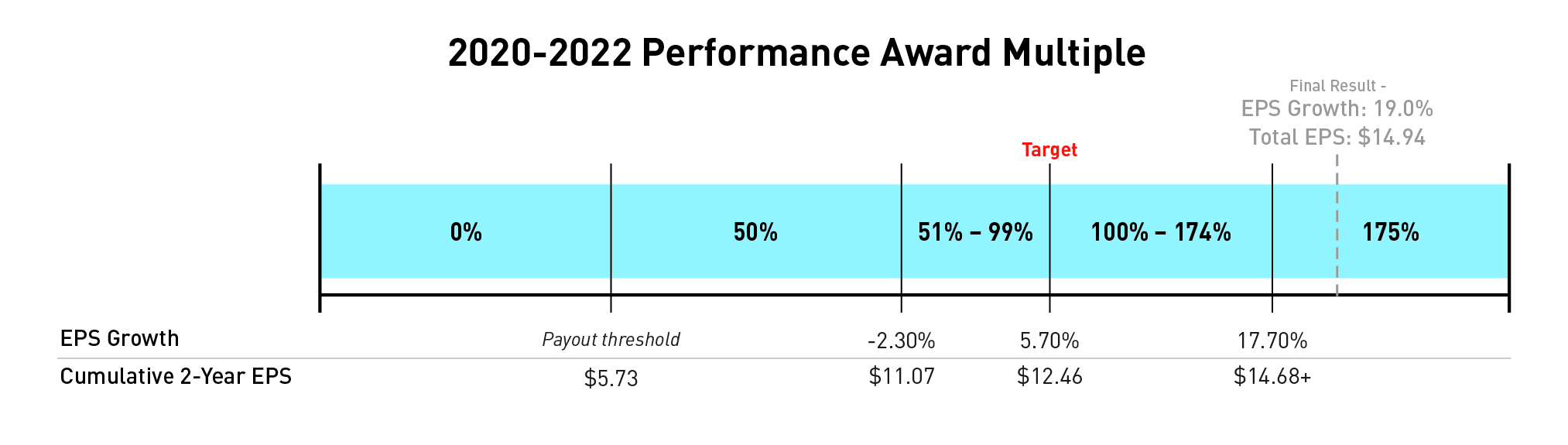

2019-2021 Shareholder Value Award

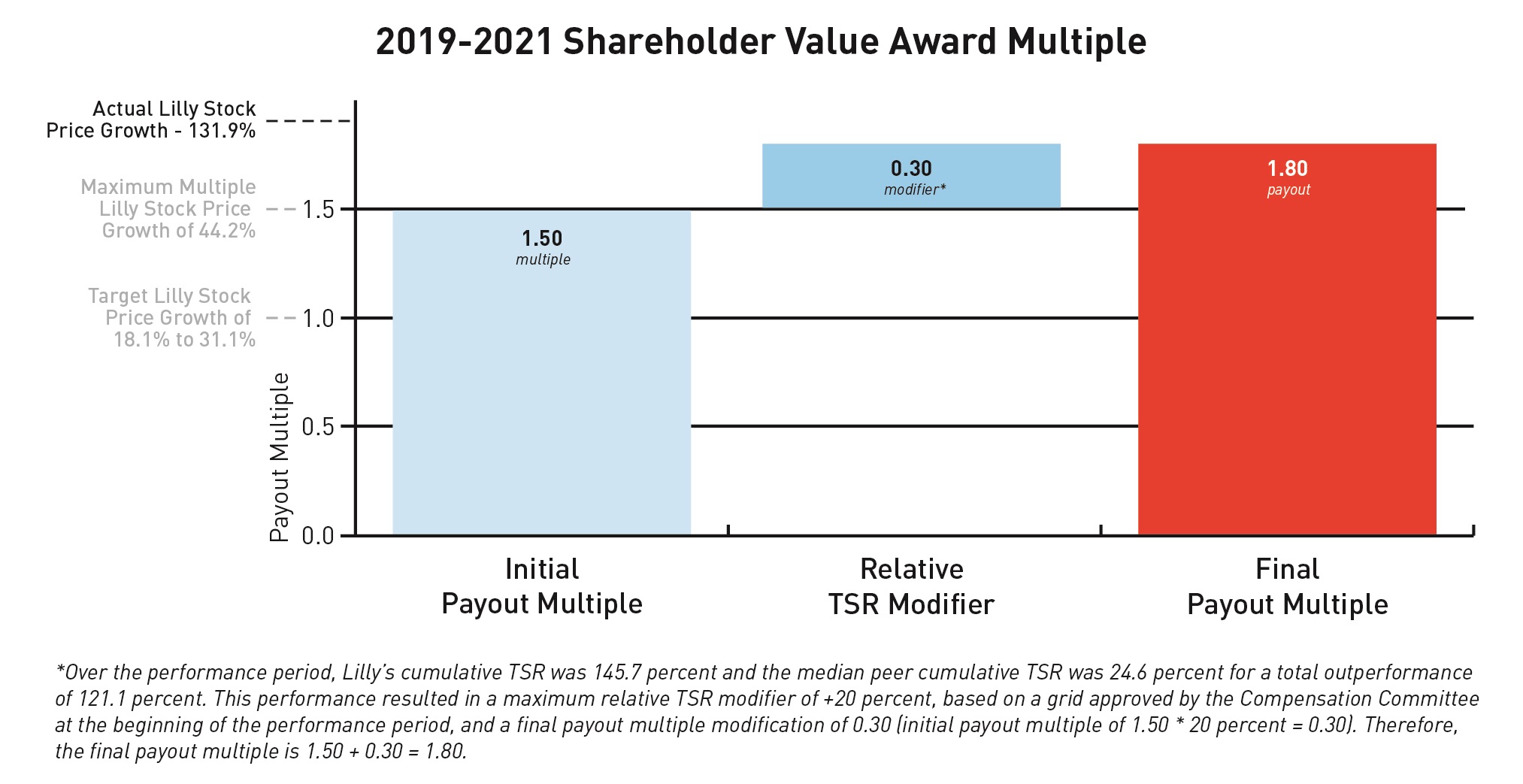

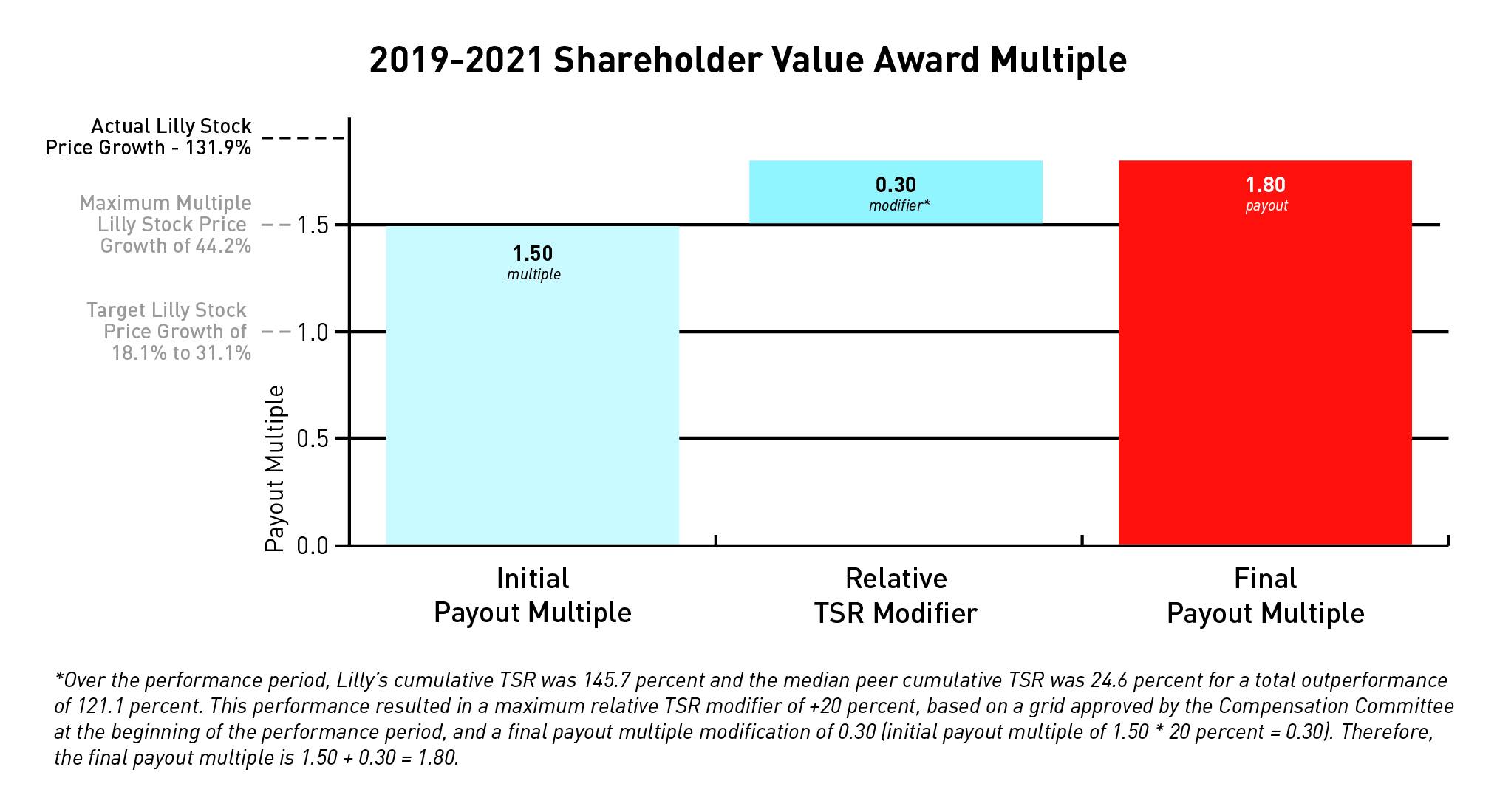

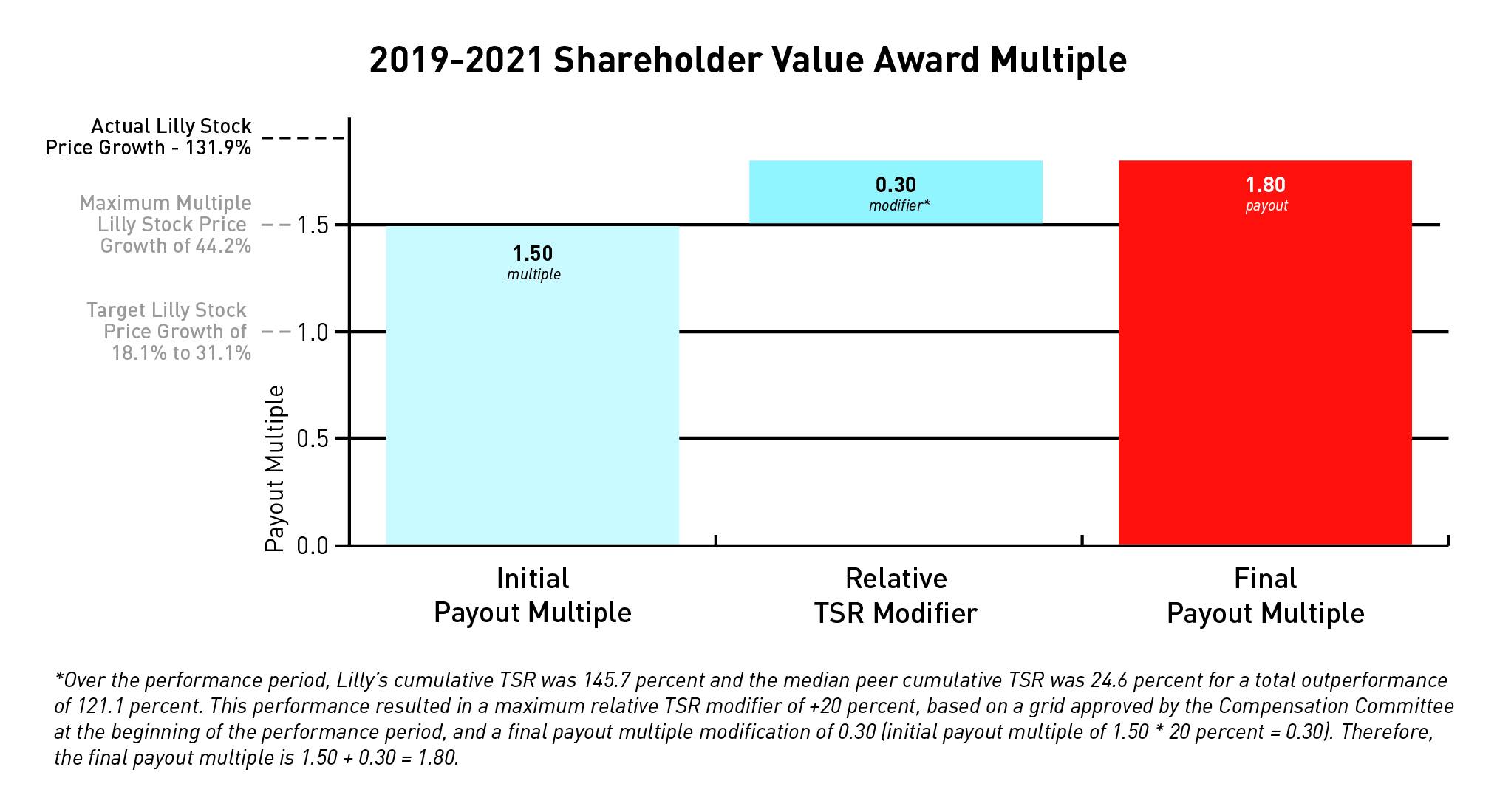

The target stock price range of $132.73 to $147.37 (18.1 percent to 31.1 percent total stock price growth) for the 2019-2021 shareholder value award was set in 2019 based on a beginning stock price of $112.38, which was the average closing price for Lilly stock for all trading days in November and December 2018. The ending stock price of $260.57 represents stock price growth of 131.9 percent over the relevant three-year period resulting in a payout multiple of 1.50.

The relative TSR modifier applies to those individuals who were executive officers when the award was granted. The cumulative TSR median for the company’s peer group was 24.6 percent, and Lilly’s TSR over the same period was 145.7 percent. Given this positive relative performance, Lilly's relative TSR was 121.1 percentage points above the peer group

median resulting in a maximum award payout of 180 percent of target. Net shares from anytarget (SVA payout must be heldmultiple of 150 percent multiplied by executive officers for a minimum of one year. Had the performance period ended December 31, 2017, the payout would have been at target.1.2 modifier = 180 percent final payout).

3 Shareholder value awards granted for the 2016-2018 performance period will vest on December 31, 2018. The number of shares reported reflects the maximum payout, which will be made if the average closing stock price in November and December 2018 is over $119.58. Actual payouts may vary from 0paid to 180 percenteach of target. Net shares from any payout must be held byour named executive officers for a minimum of one year. Had the 2019-2021 performance period ended December 31, 2017, the payout would have been 50 percent of target.were as follows:

| | | | | | | | |

Name3 | Target Shares | Shares Paid Out |

| Mr. Ricks | 68,382 | 123,088 |

Ms. Ashkenazi1 | 3,633 | 5,450 |

| Dr. Skovronsky | 22,794 | 41,029 |

Mr. Van Naarden2 | N/A | N/A |

Mr. Rau2 | N/A | N/A |